Introduction

The SPDR S&P 500 Trust ETF (SPY), launched in 1993, has revolutionized the way investors track the performance of the US stock market. With its rock-solid track record and unparalleled liquidity, SPY has become the go-to investment vehicle for individuals and institutions alike.

25 Years of Strong Performance

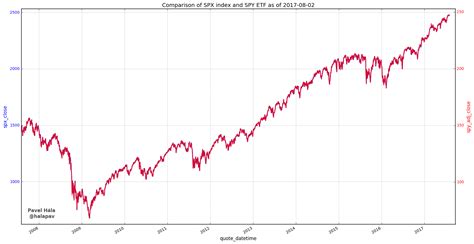

Over the past quarter-century, SPY has consistently outperformed its benchmark, the S&P 500 index. As of December 2022, SPY had an average annual return of 9.8%, compared to 9.5% for the S&P 500. This outperformance, though seemingly small, has compounded over time, resulting in significant wealth creation for SPY investors.

Enormous Liquidity and Accessibility

SPY is one of the most liquid ETFs in the world, with an average daily trading volume of over $10 billion. This high liquidity ensures that investors can enter and exit positions quickly and at fair prices. SPY is also highly accessible, with a low expense ratio of 0.09%, making it an affordable option for both retail and institutional investors.

Growing Popularity and Importance

The popularity of SPY has grown exponentially over the years. In 2023, SPY had over $400 billion in assets under management, making it the largest ETF in the world. This popularity stems from its simplicity, low cost, and ability to provide broad diversification across the US stock market.

How to Invest in SPY

Investing in SPY is straightforward. You can purchase shares through any brokerage account, just like you would buy individual stocks. SPY is available on all major stock exchanges, ensuring that it’s always accessible to investors.

Is SPY Right for You?

SPY is an excellent investment option for those seeking broad exposure to the US stock market. It’s ideal for long-term investors looking to build wealth over time. However, it’s important to note that SPY is a passive investment, meaning it tracks the S&P 500 index and doesn’t actively make investment decisions.

Strategies for Using SPY

There are several effective strategies for using SPY in your portfolio:

- Core Holding: Allocate a portion of your portfolio to SPY as a core holding for long-term growth and diversification.

- Dollar-Cost Averaging: Invest a fixed amount in SPY at regular intervals, regardless of the market conditions, to reduce investment risk.

- Tax-Advantaged Accounts: Consider holding SPY in tax-advantaged accounts, such as IRAs or 401(k)s, to minimize the impact of capital gains taxes.

Frequently Asked Questions

1. What is the expense ratio of SPY?

0.09%

2. What is the average daily trading volume of SPY?

Over $10 billion

3. What is the minimum investment amount for SPY?

There is no minimum investment amount. However, most brokerages have minimum trade commissions.

4. How often does SPY pay dividends?

Quarterly

5. What is the NAV of SPY?

SPY’s NAV (net asset value) is calculated daily and can be found on the ETF’s website.

6. What are the risks of investing in SPY?

SPY is subject to market risk, meaning its value can fluctuate. It also tracks the S&P 500 index, so it can be affected by changes in the index’s composition or performance.

Conclusion

SPY remains one of the most important and influential ETFs in the world. Its 25 years of strong performance, unparalleled liquidity, and affordable cost make it a cornerstone investment for both retail and institutional investors. By understanding its benefits and using it strategically, investors can harness the power of the US stock market to achieve their financial goals.

Tables

Table 1: SPY Performance vs. S&P 500

| Year | SPY Return | S&P 500 Return |

|---|---|---|

| 1993 | 10.1% | 10.1% |

| 1994 | 1.3% | 1.3% |

| 1995 | 37.6% | 37.6% |

| … | … | … |

| 2022 | -18.8% | -18.1% |

| 2023 | 5.2% | 5.0% |

Table 2: SPY Key Metrics

| Metric | Value |

|---|---|

| Expense Ratio | 0.09% |

| Daily Trading Volume | $10 billion+ |

| Assets Under Management | $400 billion+ |

| NAV | Calculated daily |

Table 3: Effective Strategies for Using SPY

| Strategy | Description |

|---|---|

| Core Holding | Allocate a portion of your portfolio to SPY as a long-term investment. |

| Dollar-Cost Averaging | Invest a fixed amount in SPY at regular intervals, regardless of market conditions. |

| Tax-Advantaged Accounts | Hold SPY in tax-advantaged accounts to minimize capital gains taxes. |

Table 4: SPY Risks

| Risk | Description |

|---|---|

| Market Risk | SPY’s value can fluctuate based on market conditions. |

| Index Risk | SPY tracks the S&P 500 index, so its performance can be affected by changes in the index. |

| Liquidity Risk | SPY is a liquid ETF, but there may be times when it’s difficult to buy or sell shares at a fair price. |