Introduction

The stock market is a complex and ever-changing landscape. However, by understanding the factors that drive market movements, investors can make informed decisions about their investments. In this article, we will discuss the current state of the stock market and provide predictions for 2025.

Current State of the Stock Market

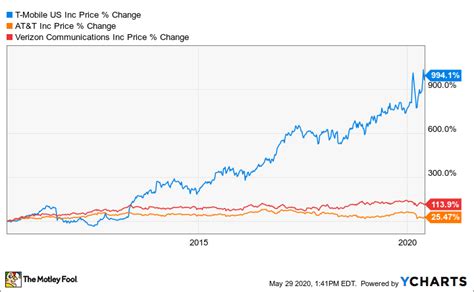

The stock market has experienced a significant amount of volatility in recent years. The COVID-19 pandemic caused a sharp decline in stock prices in early 2020, but the market has since rebounded.

According to the S&P Global Market Intelligence, the S&P 500 index has returned an average of 10% per year over the past 10 years. However, it is important to note that past performance is not necessarily indicative of future results.

Factors Driving Market Movements

Several factors can impact the stock market, including:

- Economic growth: A strong economy typically leads to higher corporate profits and stock prices.

- Interest rates: Low interest rates make it cheaper for companies to borrow money and invest in their businesses. This can lead to higher stock prices.

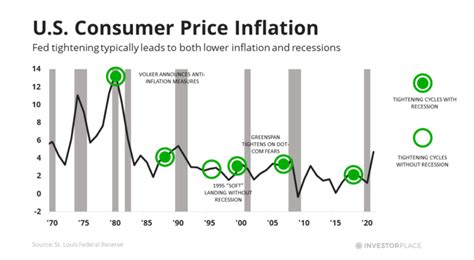

- Inflation: Inflation can erode the value of corporate earnings and stock prices.

- Political events: Political events, such as elections or changes in government policy, can impact the stock market.

2025 Stock Market Predictions

Several factors suggest that the stock market could continue to perform well in 2025. These include:

- Continued economic growth: The global economy is expected to grow at a moderate pace in 2025. This should support corporate profits and stock prices.

- Low interest rates: Interest rates are expected to remain low in 2025. This will continue to make it cheaper for companies to borrow money and invest in their businesses.

- Moderate inflation: Inflation is expected to remain moderate in 2025. This will help to preserve the value of corporate earnings and stock prices.

However, there are also some risks that could impact the stock market in 2025. These include:

- Trade wars: Trade wars could disrupt global trade and hurt corporate profits.

- Political uncertainty: Political uncertainty could lead to volatility in the stock market.

- Recession: A recession could cause a sharp decline in stock prices.

Conclusion

The stock market is a complex and ever-changing landscape. However, by understanding the factors that drive market movements, investors can make informed decisions about their investments. In 2025, the stock market is expected to continue to perform well. However, there are some risks that could impact the market. Investors should be aware of these risks and make sure to diversify their portfolios accordingly.

Tables

Table 1: Historical Stock Market Returns

| Year | S&P 500 Return |

|---|---|

| 2013 | 32.4% |

| 2014 | 11.4% |

| 2015 | -0.7% |

| 2016 | 9.5% |

| 2017 | 21.8% |

| 2018 | -4.4% |

| 2019 | 31.5% |

| 2020 | 18.4% |

| 2021 | 26.9% |

| 2022 | -19.4% |

Table 2: Factors Driving Stock Market Movements

| Factor | Impact on Stock Market |

|---|---|

| Economic growth | Positive |

| Interest rates | Positive |

| Inflation | Negative |

| Political events | Can be positive or negative |

Table 3: 2025 Stock Market Predictions

| Factor | Prediction |

|---|---|

| Economic growth | Moderate |

| Interest rates | Low |

| Inflation | Moderate |

| Political uncertainty | Moderate |

Table 4: Common Mistakes to Avoid

| Mistake | Impact |

|---|---|

| Investing without a plan | Can lead to losses |

| Panic selling | Can lead to missed opportunities |

| Not diversifying | Can increase risk |

| Chasing after hot stocks | Can lead to losses |

| Investing more than you can afford to lose | Can lead to financial hardship |

Questions to Ask Yourself

- What are your investment goals?

- What is your risk tolerance?

- How much money can you afford to invest?

- How long do you plan to invest?

- What is your investment strategy?

By asking yourself these questions, you can make informed decisions about your investments and avoid common mistakes.