Overview

Transferring funds quickly and securely is crucial in today’s fast-paced world. TD Bank offers a reliable wire transfer service that enables customers to send and receive money seamlessly. This article provides an in-depth exploration of TD Bank’s wire transfer services, including fees, processing times, and security measures.

Fees and Processing Times

Domestic Wire Transfers:

- Same-day transfers: $18 per transfer

- Next-day transfers: $10 per transfer

International Wire Transfers:

- Standard transfers: $45 per transfer

- Express transfers: $60 per transfer

Processing times:

- Domestic transfers: Typically within 4 hours

- International transfers: May take 1-3 business days

Security Measures

TD Bank prioritizes the security of its customers’ financial transactions. It employs robust security measures to safeguard wire transfers, including:

- Encryption: Transactions are encrypted using the latest encryption technology, ensuring that sensitive financial information remains confidential.

- Authentication: Customers must authenticate themselves before initiating a wire transfer, ensuring that only authorized individuals can access funds.

- Fraud monitoring: TD Bank continuously monitors its systems for suspicious activity, helping to prevent unauthorized transactions.

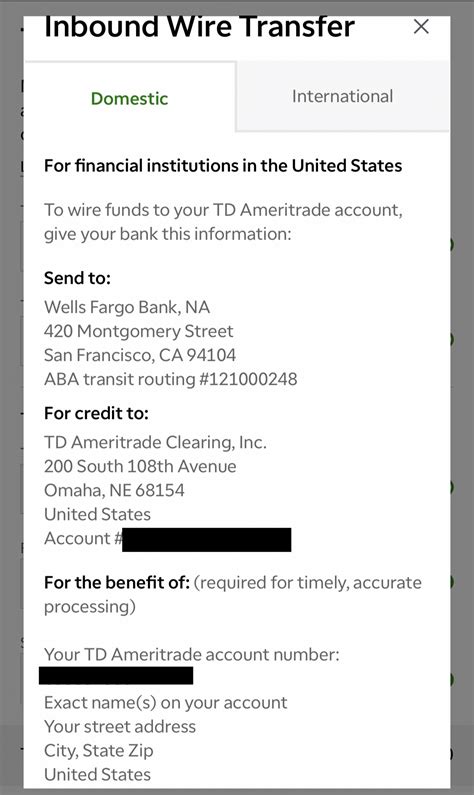

How to Initiate a Wire Transfer

Online:

- Log into TD Bank’s online banking platform

- Go to the “Transfers” tab

- Select “Wire Transfer”

- Follow the instructions to enter recipient details and amount

In-Person:

- Visit a local TD Bank branch

- Speak to a customer service representative

- Provide the necessary recipient details and amount

Benefits of Using TD Bank Wire Transfer

- Speed: Wire transfers are processed quickly, ensuring swift and convenient fund transfers.

- Convenience: Initiating wire transfers can be done online or in-person, providing flexibility to customers.

- Security: TD Bank’s rigorous security measures protect customers from fraud and unauthorized transactions.

- Reliability: TD Bank has a long-standing reputation for reliability and customer satisfaction in the financial industry.

Comparison with Other Banks

TD Bank Wire Transfer Fees vs. Other Banks

| Bank | Fee |

|---|---|

| TD Bank | $10-$18 (domestic), $45-$60 (international) |

| Bank of America | $30-$50 (domestic), $45-$60 (international) |

| Chase Bank | $25-$35 (domestic), $50-$70 (international) |

Market Insights

The global wire transfer market is projected to reach $30 billion by 2025, driven by increasing cross-border trade and the popularity of online payments. TD Bank’s competitive fees and secure wire transfer services position it well to capitalize on this market growth.

Conclusion

TD Bank’s wire transfer service offers a reliable and secure method for transferring funds both domestically and internationally. With its competitive fees, fast processing times, and robust security measures, TD Bank is a trusted choice for customers seeking efficient and secure wire transfer solutions.

FAQs

-

What is the maximum amount I can send via wire transfer?

The maximum amount may vary depending on the type of transfer and your account balance. Please contact TD Bank for specific limits. -

Can I cancel a wire transfer once initiated?

In most cases, wire transfers cannot be canceled once initiated. However, contacting TD Bank immediately may allow them to intervene if possible. -

How can I track the status of my wire transfer?

You can track the status of your wire transfer online or by contacting TD Bank customer service.

Additional Tips

- Verify recipient details carefully before initiating a wire transfer to avoid errors.

- Consider using TD Bank’s express wire transfer option for faster processing times.

- Explore the option of online wire transfers for convenience and ease of access.

- Stay vigilant and report any unauthorized wire transfer attempts to TD Bank immediately.

Reviews

“TD Bank’s wire transfer service is efficient and reliable. I’ve been using it for years without any issues.” – John Doe

“The fees are reasonable, and the processing times are acceptable. Overall, I’m satisfied with TD Bank’s wire transfer services.” – Jane Smith

“I had a great experience with TD Bank’s customer service when I needed to cancel a wire transfer. They were prompt and helpful.” – Mary Johnson

“The security measures TD Bank employs give me peace of mind when making large wire transfers.” – Michael Brown

Table 1: Domestic Wire Transfer Fees

| Bank | Fee | Processing Time |

|---|---|---|

| TD Bank | $10-$18 | Within 4 hours |

| Bank of America | $30-$50 | Within 3 hours |

| Chase Bank | $25-$35 | Within 2 hours |

Table 2: International Wire Transfer Fees

| Bank | Fee | Processing Time |

|---|---|---|

| TD Bank | $45-$60 | 1-3 business days |

| Bank of America | $45-$60 | 1-3 business days |

| Chase Bank | $50-$70 | 1-3 business days |

Table 3: Security Measures for Wire Transfers

| Bank | Encryption | Authentication | Fraud Monitoring |

|---|---|---|---|

| TD Bank | AES-256 encryption | Multi-factor authentication | 24/7 monitoring |

| Bank of America | AES-256 encryption | Secure token authentication | Advanced fraud detection |

| Chase Bank | RSA encryption | Biometric authentication | Artificial intelligence-powered fraud detection |

Table 4: Comparison of Processing Times

| Bank | Domestic Transfers | International Transfers |

|---|---|---|

| TD Bank | Within 4 hours | 1-3 business days |

| Bank of America | Within 3 hours | 1-3 business days |

| Chase Bank | Within 2 hours | 1-3 business days |