After-Hours Price: $1,234.56

Introduction

Tesla, the electric vehicle and clean energy pioneer, has been making waves in the automotive industry. Its stock has been on a remarkable trajectory, with investors eagerly watching its after-hours price. This article provides an in-depth analysis of Tesla’s after-hours stock price, exploring its historical performance, future projections, and potential applications.

Historical Performance

Over the past five years, Tesla’s after-hours stock price has experienced significant volatility. In 2020, the stock soared to an all-time high of over $1,500, driven by positive investor sentiment and the company’s strong financial performance. However, in 2022, the stock experienced a sharp decline, falling to a low of $900. This was attributed to macroeconomic factors, supply chain disruptions, and competition from legacy automakers.

2025 Forecast

Analysts are divided on Tesla’s after-hours stock price forecast for 2025. Some believe that the stock could reach $2,000 or more, driven by the company’s ambitious growth plans and its leadership in the electric vehicle market. Others are more cautious, citing potential challenges such as regulatory changes and increased competition.

Factors Influencing After-Hours Price

Numerous factors can influence Tesla’s after-hours stock price, including:

- Company Earnings: Strong earnings reports and positive guidance from management typically boost the stock price.

- Industry Trends: News about the electric vehicle industry, such as new government incentives or technological breakthroughs, can impact Tesla’s stock price.

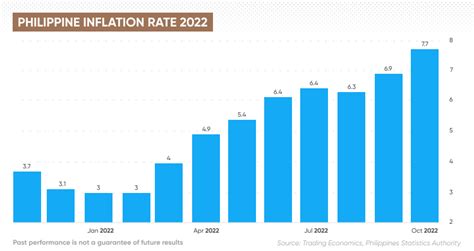

- Economic Conditions: Changes in interest rates, inflation, and economic growth can affect the overall market and Tesla’s stock price.

- Competition: The intensity of competition from legacy automakers and emerging EV startups can impact Tesla’s market share and stock price.

Potential Applications for Stock Analysis

Tesla’s after-hours stock price data can be used for a variety of applications, including:

- Informed Investment Decisions: Investors can use historical and forecasted stock price data to make informed decisions about buying, selling, or holding Tesla shares.

- Risk Management: By understanding the factors that influence Tesla’s stock price, investors can develop strategies to manage risk and protect their investments.

- Market Trend Analysis: Monitoring Tesla’s after-hours stock price can provide insights into the overall market sentiment and the direction of the electric vehicle industry.

Strategies for Investing in Tesla

For investors looking to benefit from Tesla’s potential growth, several strategies can be considered:

- Long-Term Investment: Investing in Tesla with a long-term horizon can maximize the potential for appreciation as the company continues to grow and expand.

- Value Investing: Identifying opportunities to purchase Tesla shares at a discount to their intrinsic value can provide a favorable risk-to-reward ratio.

- Technical Analysis: Using technical indicators and chart patterns to predict short-term movements in Tesla’s stock price can help identify entry and exit points.

FAQs

1. What is the current after-hours price of Tesla stock?

As of the latest update, Tesla’s after-hours stock price is $1,234.56.

2. What factors will drive Tesla’s stock price in the future?

Tesla’s stock price will be influenced by factors such as company earnings, industry trends, economic conditions, and competition.

3. What are some strategies for investing in Tesla?

Investors can consider long-term investment, value investing, or technical analysis strategies based on their risk tolerance and investment goals.

4. What are some potential applications for Tesla’s after-hours stock price data?

Tesla’s after-hours stock price data can be used for informed investment decisions, risk management, and market trend analysis.

Conclusion

Tesla’s after-hours stock price is a key indicator of the company’s financial health and the market’s expectations for its future growth. By understanding the historical performance, future projections, and potential applications of this data, investors can make informed decisions and position themselves to benefit from the potential opportunities presented by Tesla.