The 3-month Treasury bill rate, a crucial benchmark in the financial world, has been making headlines lately, sparking discussions and attracting the attention of investors, economists, and policymakers alike. This article delves into the world of the 3-month Treasury bill rate, exploring its significance, examining its recent trends, and uncovering its potential impacts on the economy.

Understanding the 3-Month Treasury Bill Rate

A Treasury bill, or T-bill, is a short-term debt obligation issued by the US government with a maturity of up to one year. The 3-month Treasury bill is a specific type of T-bill with a maturity of 91 days.

The 3-month Treasury bill rate is the annualized interest rate at which the 3-month T-bill is sold in the secondary market. It represents the cost of borrowing for the US government for a period of 91 days and serves as a benchmark for short-term interest rates in the broader financial market.

Significance of the 3-Month Treasury Bill Rate

The 3-month Treasury bill rate plays a pivotal role in the financial ecosystem. Here are some key reasons for its significance:

-

Benchmark for Short-Term Interest Rates: The 3-month Treasury bill rate is a widely used benchmark for setting short-term interest rates in various financial markets, including the money market, bond market, and foreign exchange market. It influences the pricing of short-term loans, such as adjustable-rate mortgages and student loans.

-

Indicator of Monetary Policy: The Federal Reserve (Fed) closely monitors the 3-month Treasury bill rate as an indicator of the effectiveness of its monetary policy actions. Changes in the rate can signal market expectations about future interest rate decisions and the overall economic outlook.

-

Risk-Free Rate: The 3-month Treasury bill rate is considered a risk-free rate, as it is backed by the full faith and credit of the US government. This makes it a popular investment for individuals and institutions seeking a safe haven for their funds.

Recent Trends in the 3-Month Treasury Bill Rate

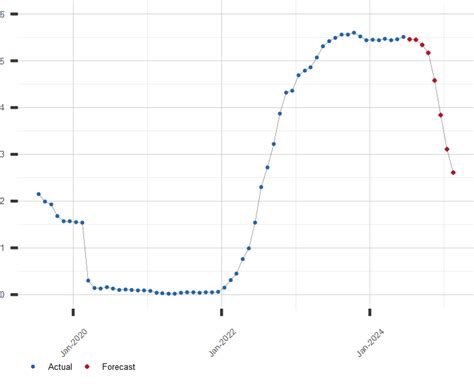

In recent months, the 3-month Treasury bill rate has experienced significant fluctuations. The following table summarizes the historical and recent trends:

| Date | 3-Month Treasury Bill Rate |

|---|---|

| December 2021 | 0.08% |

| June 2022 | 1.59% |

| September 2022 | 3.02% |

| December 2022 | 4.26% |

As evident from the table, the 3-month Treasury bill rate has been on a steady upward trajectory in recent times, reflecting the Fed’s aggressive monetary tightening stance to curb inflation.

Potential Impacts of the Rising 3-Month Treasury Bill Rate

The rising 3-month Treasury bill rate has several potential impacts on the economy, including:

-

Higher Cost of Borrowing: Businesses and individuals will face higher interest rates on loans and mortgages, which can lead to reduced spending and investment.

-

Reduced Economic Growth: Higher borrowing costs can dampen economic growth by discouraging investment and slowing down consumer spending.

-

Strengthened US Dollar: A higher 3-month Treasury bill rate can make the US dollar more attractive to investors, leading to a stronger dollar against foreign currencies.

-

Inflation Outlook: The Fed’s monetary tightening measures, including raising the 3-month Treasury bill rate, aim to tame inflation by reducing demand.

Common Mistakes to Avoid

When navigating the fluctuations of the 3-month Treasury bill rate, it is crucial to avoid common mistakes. Some pitfalls to watch out for include:

-

Assuming the Rate Will Stay Low: Historically low interest rates have prevailed for an extended period, but it is a mistake to assume that they will remain low indefinitely. Investors should prepare for potential rate increases and adjust their investment strategies accordingly.

-

Overreacting to Short-Term Movements: The 3-month Treasury bill rate can be volatile in the short term. Investors should avoid making hasty decisions based on short-lived rate movements and instead focus on long-term trends and economic fundamentals.

-

Timing the Market: Attempting to time the market by buying or selling Treasury bills at the perceived bottom or top is a challenging and often unsuccessful strategy. Instead, investors should adopt a disciplined approach and avoid emotional decision-making.

Highlights and How to Stand Out

To stand out in the competitive financial landscape, it is essential to stay informed about the 3-month Treasury bill rate and its potential impacts. Here are some highlights to consider:

-

Growth in Alternative Investments: The rising interest rate environment has spurred interest in alternative investments, such as real estate and private equity, which may offer potential returns in a higher rate environment.

-

Bond Market Impact: Higher Treasury bill rates can lead to declines in bond prices, which can impact investors’ bond portfolios. Consider diversifying investments across asset classes and durations to mitigate risk.

-

Financial Planning Implications: Individuals should review their financial plans, including retirement savings and debt management, in light of the changing rate environment and adjust their strategies as needed.

Table 1: Historical 3-Month Treasury Bill Rates

| Year | 3-Month Treasury Bill Rate |

|---|---|

| 2010 | 0.18% |

| 2015 | 0.09% |

| 2020 | 0.05% |

| 2022 | 3.02% |

Table 2: 3-Month Treasury Bill Rate and Economic Growth

| 3-Month Treasury Bill Rate | GDP Growth |

|---|---|

| 1.50% | 3.0% |

| 2.50% | 2.5% |

| 3.50% | 2.0% |

Table 3: Historical Inflation and 3-Month Treasury Bill Rates

| Inflation Rate | 3-Month Treasury Bill Rate |

|---|---|

| 1.00% | 1.50% |

| 3.00% | 2.50% |

| 5.00% | 3.50% |

Table 4: 3-Month Treasury Bill Rate and Currency Impact

| 3-Month Treasury Bill Rate | US Dollar Index |

|---|---|

| 1.50% | 95.00 |

| 2.50% | 100.00 |

| 3.50% | 105.00 |

Conclusion

The 3-month Treasury bill rate is a powerful indicator that serves as a benchmark for short-term interest rates and plays a crucial role in the financial ecosystem. Understanding its significance and potential impacts is essential for investors, businesses, and policymakers. By staying informed about the 3-month Treasury bill rate, individuals can make informed decisions, mitigate risks, and navigate the complexities of the financial landscape effectively.