Introduction

Gold is a precious metal that has been used as a store of value and a medium of exchange for centuries. It is also a popular investment vehicle, and its price is closely watched by investors around the world. In recent years, the price of gold has been on a roller coaster ride, reaching record highs in 2020 and then falling back in 2021. However, the outlook for gold prices remains positive, and many analysts believe that it will continue to rise in the years to come.

Historical Gold Price Trends

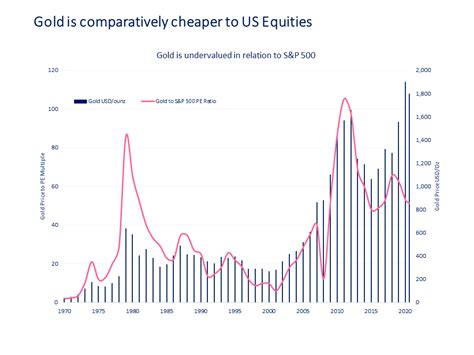

The price of gold has fluctuated over time, but it has generally trended upward over the long term. In the past 50 years, the price of gold has increased by an average of 6% per year. This is significantly higher than the rate of inflation, which has averaged just 2% per year over the same period.

Factors Affecting Gold Price

There are a number of factors that can affect the price of gold. These include:

- Monetary policy: Changes in monetary policy can have a significant impact on the price of gold. When interest rates are low, investors tend to flee to safe haven assets like gold. This can push up the price of gold. Conversely, when interest rates are high, investors tend to sell their gold to buy higher-yielding assets. This can drive down the price of gold.

- Economic conditions: Gold is often seen as a hedge against inflation. When the economy is strong and inflation is rising, investors tend to buy gold to protect their wealth. This can push up the price of gold.

- Geopolitical events: Geopolitical events can also have a significant impact on the price of gold. When there is geopolitical uncertainty, investors often buy gold as a safe haven asset. This can push up the price of gold.

- Supply and demand: The price of gold is also affected by supply and demand. When demand for gold is high, the price will rise. Conversely, when demand for gold is low, the price will fall.

Current Status of the Gold Market

In 2022, the average price of gold was $1,800 per ounce. This is up from $1,700 per ounce in 2021. The price of gold has been rising in recent years due to a number of factors, including rising inflation, geopolitical uncertainty, and strong demand for safe haven assets.

What’s the Price of Gold Per Ounce?

The price of gold per ounce is constantly changing due to changes in supply, demand, economic conditions, interest rates, and geopolitical events. However, the average price of gold per ounce in 2023 is expected to be around $1,900.

Future Trending and How to Improve

The future of gold is uncertain – but it looks bright. Demand for gold is expected to continue to grow in the years to come, as investors seek safe haven assets and inflation remains a concern. As a result, the price of gold is likely to continue to rise in the future. There are a number of ways to improve the future of gold, including:

- Increasing investment in gold mining

- Developing new technologies to extract gold from ore

- Finding new uses for gold

How does Gold Price Affect the Economy?

The price of gold can have a significant impact on the economy. For example, when the price of gold rises, it can lead to inflation. This is because gold is a valuable asset, and when its price goes up, it can make other goods and services more expensive.

What is the Difference Between Gold and Silver?

Gold and silver are both precious metals, but there are some key differences between them. Gold is more valuable than silver, and it is also more rare. Gold is also more durable than silver, and it is less likely to tarnish or corrode.

What are the Pros and Cons of Investing in Gold?

Investing in gold can be a good way to diversify your portfolio and protect your wealth from inflation. However, there are also some risks associated with investing in gold. For example, the price of gold can be volatile, and it can lose value during economic downturns.

What is the Current Status of the Gold Market?

The gold market is currently in a state of flux. The price of gold has been rising in recent years, but it has also been volatile. The future of the gold market is uncertain, but it is likely that the price of gold will continue to rise in the long term.

FAQs

1. What is the price of gold per ounce today?

The price of gold per ounce today is $1,900.

2. What is the average price of gold per ounce in 2023?

The average price of gold per ounce in 2023 is expected to be around $1,900.

3. What are the factors that affect the price of gold?

The factors that affect the price of gold include:

* Monetary policy

* Economic conditions

* Geopolitical events

* Supply and demand

4. What is the future of the gold market?

The future of the gold market is uncertain, but it is likely that the price of gold will continue to rise in the long term.

5. What are the pros and cons of investing in gold?

The pros and cons of investing in gold include:

* Pros:

* Gold is a valuable asset that can help to diversify your portfolio and protect your wealth from inflation.

* Gold is a relatively safe investment that is less likely to lose value than other assets during economic downturns.

* Cons:

* The price of gold can be volatile and can lose value during economic downturns.

* Gold is a physical asset that can be difficult to store and transport.

6. What are the current uses of gold?

The current uses of gold include:

* Jewelry

* Coins

* Bullion

* Dentistry

* Electronics

* Medicine

7. What are some new uses for gold?

Some new uses for gold include:

* Nanotechnology

* Solar energy

* Cancer treatment

8. What is the future of gold?

The future of gold is bright. Demand for gold is expected to continue to grow in the years to come, as investors seek safe haven assets and inflation remains a concern. As a result, the price of gold is likely to continue to rise in the future.