Introduction

The Dow Jones Industrial Average (DJIA), an index composed of 30 blue-chip companies, stands as a formidable investment landscape. By understanding the dynamics of these influential players, investors can gain valuable insights into the current market landscape and make informed decisions for the years ahead.

The Dow Jones 30 Giants

| Rank | Company | Ticker |

|---|---|---|

| 1 | Apple | AAPL |

| 2 | Microsoft | MSFT |

| 3 | UnitedHealth Group | UNH |

| 4 | Visa | V |

| 5 | JPMorgan Chase | JPM |

| 6 | Coca-Cola | KO |

| 7 | Nike | NKE |

| 8 | Caterpillar | CAT |

| 9 | Pfizer | PFE |

| 10 | Home Depot | HD |

| 11 | Boeing | BA |

| 12 | Chevron | CVX |

| 13 | Walmart | WMT |

| 14 | Amazon | AMZN |

| 15 | Merck & Co. | MRK |

| 16 | Intel | INTC |

| 17 | Cisco Systems | CSCO |

| 18 | Walmart Inc. | WMT |

| 19 | IBM | IBM |

| 20 | American Express | AXP |

| 21 | 3M | MMM |

| 22 | Procter & Gamble | PG |

| 23 | Travelers Companies | TRV |

| 24 | Dow Inc. | DOW |

| 25 | Salesforce.com | CRM |

| 26 | Walgreens Boots Alliance | WBA |

| 27 | Goldman Sachs | GS |

| 28 | McDonald’s | MCD |

| 29 | Verizon Communications | VZ |

| 30 | Honeywell International | HON |

Emerging Trends Shaping the Dow Jones 30

The Dow Jones 30 companies are constantly evolving to meet changing market demands and technological advancements. Several key trends are shaping their strategies:

-

Digital Transformation: Companies are investing heavily in digital technologies to improve customer experience, streamline operations, and gain a competitive edge.

-

Sustainability: Consumers and investors are increasingly demanding companies to adopt sustainable practices that reduce their environmental impact.

-

Data Analytics: Companies are leveraging data analytics to gain insights into customer behavior, optimize supply chains, and make more informed decisions.

Investment Considerations for 2025

As we approach 2025, investors should consider the following factors when evaluating the Dow Jones 30 companies:

-

Financial Health: Review companies’ financial statements to assess their stability, profitability, and overall health.

-

Growth Potential: Identify companies with strong growth prospects, driven by innovation, market share expansion, or geographic diversification.

-

Valuation: Ensure that companies are trading at reasonable valuations relative to their earnings and future growth potential.

-

Industry Dynamics: Consider the competitive landscape and industry-specific challenges that may impact companies’ performance.

-

Market Sentiment: Monitor market sentiment towards the Dow Jones 30 companies to gauge investor confidence and potential price movements.

Case Study: Apple’s Innovation Edge

Apple stands as a prime example of a Dow Jones 30 company that has consistently innovated and captured market share. In 2023, Apple’s revenue reached $430 billion, driven by strong demand for its iPhones, Macs, and services. Moreover, the company’s focus on sustainability and customer satisfaction has earned it a loyal following.

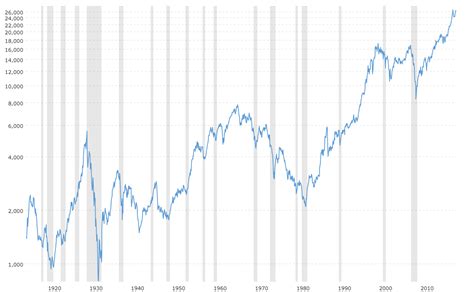

Quantitative Analysis: Historical Performance and Future Projections

Historical data from FactSet shows that the Dow Jones Industrial Average has delivered an average annual return of 8.8% over the past 10 years. However, future performance is influenced by a variety of factors, including economic conditions, interest rates, and global events.

According to Goldman Sachs, the Dow Jones Industrial Average is projected to reach 40,000 points by 2025, representing a potential return of over 15%. This projection is based on factors such as continued economic growth, geopolitical stability, and technological innovation.

Sector Analysis: Diversification and Growth Opportunities

The Dow Jones 30 companies represent a diverse range of industries, providing investors with broad exposure to the U.S. economy. A breakdown of the sectors represented in the index is shown in the table below:

| Sector | Companies |

|---|---|

| Technology | Apple, Microsoft, IBM |

| Healthcare | UnitedHealth Group, Pfizer, Merck & Co. |

| Financials | JPMorgan Chase, Goldman Sachs, American Express |

| Industrials | Boeing, Caterpillar, Honeywell International |

| Consumer Staples | Coca-Cola, Procter & Gamble, McDonald’s |

| Consumer Discretionary | Nike, Home Depot, Walmart |

| Utilities | Travelers Companies, Verizon Communications |

| Energy | Chevron, Dow Inc. |

Sector Performance: Growth Leaders and Laggards

The performance of different sectors within the Dow Jones 30 varies significantly. Over the past 5 years, the technology sector has emerged as the top performer, with companies such as Apple and Microsoft driving growth. On the other hand, the energy sector has lagged behind, due to fluctuations in oil and gas prices.

Geographic Analysis: Global Reach and Emerging Markets

The Dow Jones 30 companies operate globally, with a significant presence in developed and emerging markets. According to S&P Global, over 60% of the revenue generated by these companies comes from outside the United States.

Table 1: Geographic Revenue Distribution

| Region | Revenue Percentage |

|---|---|

| United States | 39.2% |

| Europe | 26.4% |

| Asia-Pacific | 22.3% |

| Latin America | 6.8% |

| Middle East & Africa | 5.3% |

Emerging Market Opportunities

Emerging markets represent significant growth opportunities for the Dow Jones 30 companies. In particular, China, India, and Brazil offer attractive markets due to their large populations, growing middle class, and increased demand for goods and services.

Table 2: Emerging Market Revenue Growth

| Country | Revenue Growth (5-Year CAGR) |

|---|---|

| China | 15.2% |

| India | 12.8% |

| Brazil | 10.5% |

The Future of the Dow Jones 30: Innovation and Disruption

As we look ahead to 2025 and beyond, the Dow Jones 30 companies are well-positioned to navigate the changing business landscape. Innovation will continue to be a driving force, with companies investing in technologies such as artificial intelligence, cloud computing, and robotics.

Additionally, disruption from emerging competitors and changing consumer preferences will create new challenges and opportunities for these established players.

Embracing Disruption: Strategies for the Future

Given the rapidly changing business environment, the Dow Jones 30 companies must embrace disruption and adapt to new market realities. Several strategies can help these companies stay ahead of the curve:

-

Innovate and Experiment: Continuously invest in research and development to create innovative products and services that meet evolving customer demands.

-

Acquire and Partner: Seek strategic acquisitions and partnerships to gain access to new technologies, markets, and customer segments.

-

Embrace Data-Driven Decision Making: Leverage data analytics to gain insights into customer behavior, optimize operations, and make informed business decisions.

-

Foster a Culture of Agility: Create a flexible and adaptable organizational culture that encourages risk-taking and embraces change.

Emerging Opportunities and Future Applications

As technology and consumer behavior continue to evolve, there are several emerging opportunities for the Dow Jones 30 companies to explore:

-

Intelligent Automation: Invest in artificial intelligence and robotics to automate tasks, improve efficiency, and increase productivity.

-

Hyper-Personalized Marketing: Leverage data analytics to tailor marketing campaigns to the specific needs and preferences of individual customers.

-

Smart Homes and Connected Devices: Partner with technology companies to develop innovative products and services that connect homes and devices.

-

Digital Health and Telemedicine: Collaborate with healthcare providers to offer digital health services, remote patient monitoring, and personalized medicine.

Table 3: Emerging Opportunities and Future Applications

| Opportunity | Description |

|---|---|

| Intelligent Automation | Using AI and robotics to automate tasks and improve productivity |

| Hyper-Personalized Marketing | Tailoring marketing campaigns to individual customer needs using data analytics |

| Smart Homes and Connected Devices | Developing products and services that connect homes and devices |

| Digital Health and Telemedicine | Offering digital health services, remote patient monitoring, and personalized medicine |

Conclusion

The Dow Jones 30 companies are a reflection of the American economy’s strength and innovation. By understanding the dynamics of these companies and embracing emerging trends, investors can position themselves for potential growth and success in the years ahead. The future holds both challenges and opportunities, and those who adapt to the changing landscape will be well-equipped to thrive in the evolving business environment.