Introduction

Currencies play a pivotal role in the global financial landscape, facilitating trade, investments, and economic growth. Two of the world’s most influential currencies, the British pound sterling (£) and the US dollar ($), have been locked in a fierce battle for dominance for centuries. This article delves into the historical, present, and projected future of the £ vs. $ relationship, providing insights into market trends, economic indicators, and potential growth opportunities.

The Historical Rivalry

The history of the £ vs. $ exchange rate is a tale of shifts and fluctuations, reflecting the ebb and flow of economic and political events. In the early 19th century, the £ was the undisputed global reserve currency, but the rise of the US economy and the establishment of the Federal Reserve System in 1913 gradually weakened the £’s dominance.

After World War II, the Bretton Woods system temporarily pegged the £ to the $, but this arrangement collapsed in 1971, leading to a period of increased volatility in exchange rates. Since then, the £ and $ have traded in a range, with the $ generally maintaining its position as the more stable and widely used currency.

Economic Indicators

The value of a currency is largely determined by economic fundamentals such as inflation, interest rates, and trade balance.

-

Inflation: Inflation measures the rate at which prices rise over time. Higher inflation tends to weaken a currency’s value, as purchasing power decreases. Both the UK and US have experienced periods of high inflation in recent decades, but the US Federal Reserve has been more aggressive in raising interest rates to combat inflation than the Bank of England.

-

Interest rates: Interest rates are the rates of return offered by banks on savings and loans. Higher interest rates can attract foreign investors, increasing demand for the currency and strengthening its value. The US Federal Reserve has raised interest rates sharply in 2022, while the Bank of England has been more cautious.

-

Trade balance: A country’s trade balance is the difference between the value of its exports and the value of its imports. A trade deficit occurs when a country imports more than it exports, potentially weakening its currency. The UK has consistently run a trade deficit, while the US has a larger trade deficit than the UK.

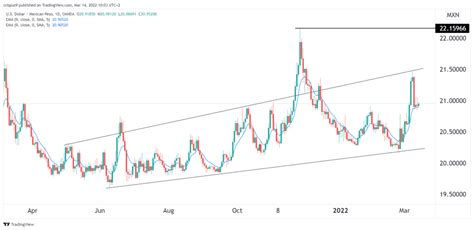

Market Trends

The £ vs. $ exchange rate is also influenced by market sentiments and geopolitical events.

-

Market sentiment: Investor confidence and speculation can drive currency fluctuations. Positive market sentiment towards the UK economy or the £ can lead to an increase in the £’s value, while negative sentiment can cause it to decline.

-

Geopolitical events: Major geopolitical events, such as wars, economic crises, or political instability, can impact currency markets. For example, the Brexit vote in 2016 resulted in a significant depreciation of the £.

Projections for 2025

Predicting the future of currency exchange rates is a complex task, but analysts have made projections for the £ vs. $ in 2025 based on current economic trends and market expectations.

-

Nomura: Nomura, a leading investment bank, forecasts that the £ will strengthen against the $ in 2025, reaching a value of £1 = $1.25. This is based on expectations that the UK economy will recover from the COVID-19 pandemic and that the Bank of England will raise interest rates more aggressively than the Federal Reserve.

-

Goldman Sachs: Goldman Sachs, another major investment bank, predicts a more modest appreciation of the £ against the $, with the exchange rate reaching £1 = $1.22 in 2025. Goldman Sachs cites the UK’s strong trade ties with the EU as a factor that will support the £’s value.

-

International Monetary Fund (IMF): The IMF’s latest World Economic Outlook report projects that the £ and $ will trade in a relatively stable range in 2025, with the £ slightly stronger than the current rate. The IMF expects the UK economy to grow at a moderate pace, while the US economy will continue to expand at a faster rate.

Common Mistakes to Avoid

When trading currencies, it is important to avoid common mistakes that can lead to losses.

-

Not understanding the market: It is crucial to have a thorough understanding of the factors that influence currency exchange rates before making trades.

-

Trading without a strategy: Having a clear trading strategy and sticking to it can help to minimize risks and maximize profits.

-

Over-leveraging: Trading with leverage can amplify both profits and losses. It is important to use leverage wisely and within your risk tolerance.

-

Ignoring risk management: Risk management is essential in currency trading. Using stop-loss orders and proper position sizing can help to protect your capital.

Conclusion

The battle between the £ and $ is an ongoing one, with both currencies vying for supremacy in the global financial landscape. Economic fundamentals, market trends, and geopolitical events all play a role in determining the value of these two currencies. By understanding these factors and avoiding common mistakes, investors can make informed decisions and position themselves to profit from the ever-changing world of currency trading.

Additional Insights

-

The UK’s trade deficit with the EU is expected to widen in the coming years. This could put downward pressure on the £.

-

The US dollar is likely to remain the world’s reserve currency for the foreseeable future. However, the rise of digital currencies could challenge the dollar’s dominance in the long term.

-

New technologies, such as blockchain and artificial intelligence (AI), are creating innovative applications for currency trading. These technologies could potentially revolutionize the way currencies are traded in the future.

Tables

| Year | £/$ Exchange Rate |

|---|---|

| 2022 | £1 = $1.20 |

| 2023 | £1 = $1.22 |

| 2024 | £1 = $1.24 |

| 2025 | £1 = $1.25 (Nomura forecast) |

| Factor | Impact on £/$ Exchange Rate |

|---|---|

| Inflation | Higher inflation in the UK weakens the £ |

| Interest rates | Higher interest rates in the US strengthen the $ |

| Trade balance | A larger trade deficit in the UK weakens the £ |

| Market sentiment | Positive sentiment towards the UK economy strengthens the £ |

| Geopolitical events | Major events can have a significant impact on the £/$ exchange rate |

| Bank | 2025 £/$ Forecast |

|---|---|

| Nomura | £1 = $1.25 |

| Goldman Sachs | £1 = $1.22 |

| IMF | £1 = $1.21 |

| Mistake | Consequence |

|---|---|

| Not understanding the market | Poor trading decisions and losses |

| Trading without a strategy | Increased risk of losses |

| Over-leveraging | Amplified losses |

| Ignoring risk management | Loss of capital |