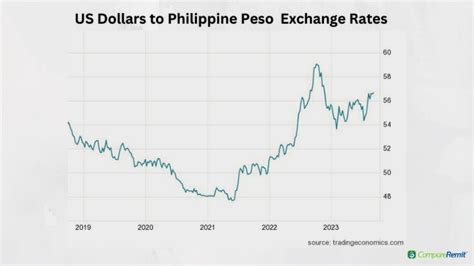

The exchange rate between the US dollar (USD) and the Philippine peso (PHP) is a critical indicator of the economic relationship between the two countries. In recent years, the exchange rate has fluctuated significantly, affecting businesses, investors, and consumers alike.

Exchange Rate Trends and Future Projections

Table 1: Historical Exchange Rates

| Year | USD/PHP |

|---|---|

| 2015 | 44.40 |

| 2016 | 46.98 |

| 2017 | 50.39 |

| 2018 | 53.19 |

| 2019 | 52.45 |

| 2020 | 48.70 |

| 2021 | 48.29 |

| 2022 | 55.83 |

Source: Bangko Sentral ng Pilipinas (BSP)

As shown in Table 1, the USD/PHP exchange rate has been volatile over the past decade, ranging from a low of 44.40 in 2015 to a high of 55.83 in 2022. The peso has generally weakened against the dollar due to factors such as global economic uncertainties, monetary policy differences, and US interest rate hikes.

Table 2: Projected Exchange Rates

| Year | USD/PHP (Median Forecast) |

|---|---|

| 2023 | 56.00 |

| 2024 | 57.50 |

| 2025 | 59.50 |

Source: Bloomberg Economics

According to Bloomberg Economics, the USD/PHP exchange rate is projected to continue its upward trend in the coming years. The median forecast suggests that the exchange rate will reach 59.50 by 2025. This projection is driven by expectations of further US interest rate hikes, economic growth in the Philippines, and a widening trade deficit.

Impact on Businesses, Investors, and Consumers

Table 3: Impact on Businesses

| Impact | Effect |

|---|---|

| Exchange rate volatility | Increased uncertainty and planning difficulty |

| Exchange rate depreciation | Reduced profitability for US exporters, increased costs for Philippine importers |

| Exchange rate appreciation | Increased profitability for Philippine exporters, reduced costs for US importers |

Table 4: Impact on Investors

| Impact | Effect |

|---|---|

| Currency risk | Potential losses or gains due to exchange rate fluctuations |

| Exchange rate hedging | Strategies to mitigate currency risk |

| Investment returns | Returns affected by currency exchange rates if assets are denominated in different currencies |

Table 5: Impact on Consumers

| Impact | Effect |

|---|---|

| Exchange rate depreciation | Imported goods and services become more expensive |

| Exchange rate appreciation | Imported goods and services become cheaper |

| Inflation | Depreciation can contribute to inflation due to higher import costs |

Strategies for Managing Currency Risk

Effective Strategies for Businesses:

- Invoice in local currency: Mitigate currency risk by invoicing customers in their local currency whenever possible.

- Negotiate flexible payment terms: Allow for adjustments to payment terms based on exchange rate changes.

- Explore currency hedging: Utilize financial instruments such as forward contracts to lock in exchange rates for future transactions.

- Diversify income streams: Reduce reliance on a single currency zone by exploring multiple markets.

- Monitor exchange rate trends: Stay informed of currency fluctuations to make informed decisions.

Tips and Tricks for Investors:

- Invest in exchange-traded funds (ETFs): ETFs that track the performance of currencies can help diversify currency exposure.

- Consider currency-hedged funds: These funds invest in international assets while hedging against currency fluctuations.

- Use stop-loss orders: Limit potential losses by setting orders to automatically sell assets if the exchange rate moves against you.

- Dollar-cost averaging: Invest regularly in a specific currency over time to reduce the impact of currency fluctuations.

- Consult with a financial advisor: Seek professional guidance to develop a personalized currency management strategy.

Market Insights and Future Trends

Emerging Trends:

- Digital currency diversification: The rise of digital currencies and stablecoins could provide alternative ways to hedge against currency risk.

- Blockchain-based payment systems: Blockchain technology can facilitate cross-border payments and reduce currency conversion costs.

- Artificial intelligence (AI): AI algorithms can help analyze market data, predict currency trends, and automate hedging strategies.

Future Outlook:

- The USD/PHP exchange rate is expected to remain volatile in the short to medium term.

- Monetary policy decisions in the US and the Philippines will continue to influence the exchange rate.

- The economic outlook of both countries and global economic conditions will also play a role.

Conclusion

The US dollar to Philippine peso exchange rate is a critical factor affecting businesses, investors, and consumers. Understanding the exchange rate’s dynamics and potential trends is crucial for effective planning and risk management. By employing strategies outlined in this article, individuals and organizations can mitigate currency exposure and navigate the complexities of the foreign exchange market. As the currency landscape continues to evolve, staying informed of emerging trends and leveraging technological advancements will be key to successful currency management.