Hot Search Title: Stock Market 2025: Experts Predict Epic Bull Run for Buy-and-Holders

Introduction

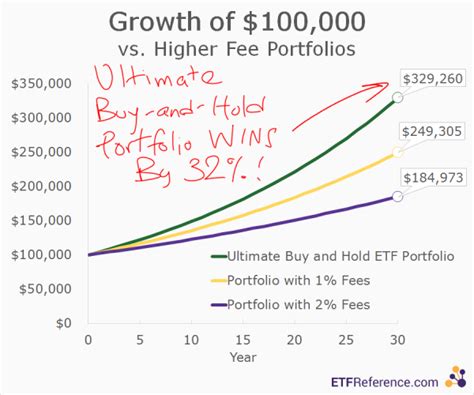

In the volatile world of investing, the buy-and-hold strategy has stood the test of time, delivering consistent returns over the long haul. For investors seeking stability and wealth accumulation, understanding the latest buy-and-hold news is crucial. This comprehensive guide will provide insights into the current landscape, expert predictions, and actionable strategies to harness the power of buy-and-hold investing.

According to a recent report by Goldman Sachs, the global stock market is projected to continue on an upward trajectory in 2023. The firm estimates that the S&P 500 index will reach 5,000 by the end of the year, representing a 10% increase from its current level. This optimistic outlook is driven by several factors, including:

- Economic recovery: The global economy is expected to recover from the pandemic-induced downturn, with GDP growth forecasts rising.

- Low interest rates: Central banks are maintaining low interest rates, which makes stocks more attractive to investors seeking yield.

- Record corporate earnings: Corporations are reporting strong earnings, buoyed by increased consumer spending and government stimulus.

Expert Predictions: Buy-and-Hold Dominance in 2023 and Beyond

Renowned investment strategists are bullish on buy-and-hold investing for the coming years. Here are some key predictions:

- Warren Buffett: “The stock market is a device for transferring money from the impatient to the patient.”

- Vanguard Research: “Over the long term, a diversified portfolio of stocks and bonds outperforms cash.”

- Fidelity Investments: “Time in the market, not timing the market, is the key to investment success.”

Actionable Strategies for Buy-and-Hold Success

Embracing a buy-and-hold approach requires a well-defined strategy. Consider the following steps:

1. Set Long-Term Goals: Define your investment objectives and time horizon, whether it’s retirement, education funding, or wealth preservation.

2. Diversify Portfolio: Spread your investments across different asset classes (e.g., stocks, bonds, real estate) and sectors to reduce risk.

3. Rebalance Regularly: Periodically adjust the allocation of your portfolio to maintain your desired risk tolerance and investment goals.

4. Stay Disciplined: Market fluctuations are inevitable. Avoid emotional decision-making and stick to your investment plan.

Pros:

- Potential for Long-Term Growth: Equities have historically provided higher returns than bonds or cash over extended periods.

- Outperforms Inflation: Stock returns tend to outpace inflation, preserving the purchasing power of your investments.

- Tax Benefits: Long-term capital gains are taxed at lower rates, reducing the impact of taxes on your earnings.

Cons:

- Market Risk: Stocks can fluctuate in value, potentially resulting in losses in the short term.

- Lack of Liquidity: Buy-and-hold investments are not easily accessible for short-term needs.

- Time Commitment: This strategy requires a multi-year investment horizon and patience.

The stock market has experienced a strong recovery since the pandemic lows. However, geopolitical uncertainties and rising inflation pose challenges to the market outlook. Despite these concerns, long-term investors should remain focused on their investment goals and ride out market volatility.

What We Can Do:

- Stay informed: Monitor market news and economic data to make informed decisions.

- Invest gradually: Avoid investing large sums at once. Instead, gradually add to your portfolio over time.

- Seek professional guidance: Consider consulting with a financial advisor to develop a customized investment plan.

Innovative Applications: “Pennystocking”

“Pennystocking” is a novel approach to buy-and-hold investing that involves purchasing undervalued stocks at extremely low prices (typically below $1). By holding these stocks for an extended period, investors aim to capitalize on potential price appreciation as the companies grow or gain recognition. While this strategy has the potential for high returns, it also carries a higher degree of risk.

Tables for Reference

| Market Outlook | Projection |

|---|---|

| Global Stock Market Growth (2023) | +10% |

| S&P 500 Index (2023) | 5,000 |

| Long-Term Stock Returns | 7-10% per year |

| Buy-and-Hold Strategies | Key Steps |

|---|---|

| Set Long-Term Goals | Define investment objectives and time horizon. |

| Diversify Portfolio | Spread investments across different asset classes and sectors. |

| Rebalance Regularly | Adjust portfolio allocation to maintain risk tolerance. |

| Stay Disciplined | Avoid emotional decision-making and stick to the plan. |

| Pros of Buy-and-Hold Investing | Cons of Buy-and-Hold Investing |

|---|---|

| Potential for Long-Term Growth | Market Risk |

| Outperforms Inflation | Lack of Liquidity |

| Tax Benefits | Time Commitment |

| Pennystocking | Key Characteristics |

|---|---|

| Purchase of Undervalued Stocks | Low Purchase Prices (Typically Below $1) |

| Long-Term Investment Horizon | Potential for High Returns |

| Higher Risk | Requires Extensive Research and Due Diligence |

Conclusion

Buy-and-hold investing remains a powerful tool for building long-term wealth. By understanding the current market outlook, following expert predictions, and implementing effective strategies, investors can harness the benefits of this time-tested approach. Remember, patience, diversification, and discipline are key to success in the world of buy-and-hold investing. As the stock market continues to evolve, it’s essential to stay informed, innovate, and stay committed to your investment goals.