Table of Contents

- What is a Short-Term Capital Gain?

- Calculating Short-Term Capital Gains

- Short-Term Capital Gains Tax Rates

- Tax Treatment Differences in 2023 and 2025

- Strategies for Minimizing Short-Term Capital Gains

- Impact on Investments and Portfolio Management

- FAQs on Short-Term Capital Gains

- Market Insights: The Rising Importance of Short-Term Capital Gains

- How to Stand Out in the Short-Term Capital Gains Market

- Future Trends and Improvement Strategies

What is a Short-Term Capital Gain?

A short-term capital gain is the profit you make from the sale of an asset, such as a stock or bond, that you held for one year or less.

Calculating Short-Term Capital Gains

To calculate your short-term capital gain, subtract the purchase price of the asset from the sale price:

Short-Term Capital Gain = Sale Price - Purchase Price

Short-Term Capital Gains Tax Rates

The short-term capital gains tax rate is determined by your ordinary income tax bracket. In 2023, the rates range from 10% to 37%, depending on your income level.

| Income Level | Tax Rate |

|---|---|

| $0 – $9,950 | 10% |

| $9,951 – $40,525 | 12% |

| $40,526 – $86,375 | 22% |

| $86,376 – $164,925 | 24% |

| $164,926 – $209,425 | 32% |

| $209,426 – $523,600 | 35% |

| Over $523,600 | 37% |

In 2025, the tax rates will slightly decrease due to the Tax Cuts and Jobs Act.

Tax Treatment Differences in 2023 and 2025

The Tax Cuts and Jobs Act, which took effect in 2018, made several changes to the tax treatment of short-term capital gains. These changes will impact investors in 2025 as follows:

- Increased standard deduction: The standard deduction will increase to $12,950 for single filers and $25,900 for married couples filing jointly. This will reduce the amount of taxable income for many investors, potentially lowering their short-term capital gains tax.

- Reduced tax rates: The maximum short-term capital gains tax rate will decrease to 35% in 2025. This means that investors in the highest tax bracket will pay a lower tax rate on their short-term capital gains.

Strategies for Minimizing Short-Term Capital Gains

There are several strategies you can use to minimize your short-term capital gains tax liability. These include:

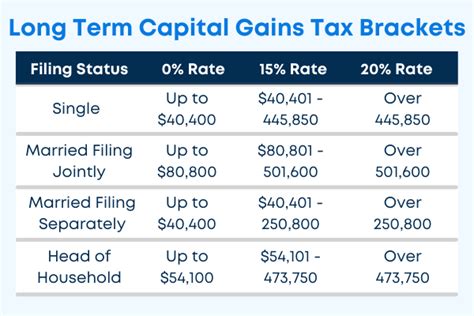

- Holding assets for more than one year: By holding assets for more than one year, you can convert them into long-term capital gains, which are taxed at a lower rate.

- Using tax-loss harvesting: If you have losses on other investments, you can sell those investments to offset your short-term capital gains.

- Donating appreciated assets: Donating appreciated assets to charity allows you to avoid paying any capital gains tax on the donation.

- Investing in tax-advantaged accounts: Investing in tax-advantaged accounts, such as IRAs or 401(k)s, allows your investments to grow tax-free.

Impact on Investments and Portfolio Management

The short-term capital gains tax rate can have a significant impact on your investment and portfolio management decisions. Investors who are considering selling assets within a year of purchase should be aware of the tax implications and consider strategies to minimize their tax liability.

FAQs on Short-Term Capital Gains

Q: What is the difference between short-term and long-term capital gains?

A: Short-term capital gains are profits from the sale of assets held for one year or less, while long-term capital gains are profits from the sale of assets held for more than one year.

Q: How do I calculate my short-term capital gains tax liability?

A: Subtract your purchase price from the sale price, then multiply the difference by your ordinary income tax bracket.

Q: What are some strategies for minimizing my short-term capital gains tax liability?

A: Holding assets for more than one year, using tax-loss harvesting, donating appreciated assets, and investing in tax-advantaged accounts can all help to minimize your tax liability.

Q: How will the Tax Cuts and Jobs Act affect my short-term capital gains tax liability in 2025?

A: The Tax Cuts and Jobs Act increases the standard deduction and reduces the maximum short-term capital gains tax rate, which may lower your tax liability.

Market Insights: The Rising Importance of Short-Term Capital Gains

In recent years, short-term capital gains have become increasingly important in the financial markets. This is due to several factors, including:

- Increased volatility: The stock market has become increasingly volatile in recent years, which has led to more frequent short-term trading.

- Technological advances: Online trading platforms have made it easier for investors to trade stocks and other assets on a short-term basis.

- Growth of quantitative trading: Hedge funds and other institutional investors often use quantitative trading strategies to identify and capitalize on short-term trading opportunities.

As a result of these factors, the short-term capital gains market is expected to continue to grow in the years to come.

How to Stand Out in the Short-Term Capital Gains Market

To stand out in the short-term capital gains market, investors need to develop a deep understanding of the market dynamics and risks involved. They should also consider using the following strategies:

- Specialize in a particular sector or industry: By specializing in a particular sector or industry, investors can gain a deep understanding of the market and identify undervalued opportunities.

- Use technical analysis: Technical analysis can help investors identify short-term trading opportunities by analyzing price patterns.

- Use algorithmic trading: Algorithmic trading allows investors to automate their trading strategies and execute trades quickly.

Future Trends and Improvement Strategies

The future of the short-term capital gains market is bright. As the market continues to grow, investors will need to develop new and innovative strategies to succeed. Some of the future trends and improvement strategies that investors should consider include:

- Machine learning and artificial intelligence: Machine learning and artificial intelligence can help investors to identify trading opportunities and make better decisions.

- Blockchain technology: Blockchain technology can help to improve the efficiency and security of trading.

- Increased regulation: As the short-term capital gains market continues to grow, regulators are likely to increase regulation to protect investors.

By staying ahead of these trends and implementing effective improvement strategies, investors can position themselves to succeed in the short-term capital gains market.

Conclusion

The short-term capital gains tax rate can have a significant impact on your investment and portfolio management decisions. By understanding the tax implications and using effective strategies to minimize your tax liability, you can maximize your investment returns.