Introduction

The US-RMB exchange rate is a crucial economic indicator that reflects the relative value of the US dollar and the Chinese renminbi (RMB). In recent years, this exchange rate has witnessed significant fluctuations, impacting global trade, investment, and economic growth. As we approach 2025, it becomes increasingly important to understand the factors driving this exchange rate and its potential implications for businesses and investors.

Factors Influencing the US-RMB Exchange Rate

- Economic Growth: The economic growth rates of the United States and China are major determinants of the exchange rate. Strong economic growth in one country can lead to a higher demand for its currency, pushing up its value relative to the other.

- Interest Rate Differentials: Differences in interest rates between the United States and China can also affect the exchange rate. Higher interest rates in the United States can make the dollar more attractive to investors, leading to a rise in its value against the RMB.

- Trade Flows: The volume and composition of trade between the United States and China influence the exchange rate. A trade surplus for the United States typically signifies a high demand for the dollar, increasing its value against the RMB.

- Foreign Direct Investment (FDI): FDI inflows into China can strengthen the RMB, as foreign investors purchase RMB to invest in the Chinese economy. Conversely, FDI outflows from China can weaken the RMB as Chinese investors sell RMB to acquire foreign currencies.

- Political and Geopolitical Factors: Political tensions and geopolitical events can have a significant impact on the exchange rate. Uncertainty or instability in either country can lead to investors selling off their holdings, resulting in currency fluctuations.

Historical Trends and Predictions

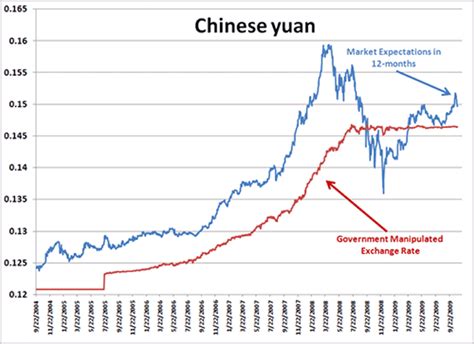

Historical Trends

From 2010 to 2020, the US-RMB exchange rate fluctuated between 6.2 and 7.2, with a slight downward trend. The RMB gradually strengthened against the dollar during this period.

Predictions for 2025

According to economists, the US-RMB exchange rate is expected to continue its gradual appreciation towards 2025. The Chinese government’s efforts to liberalize the RMB and increase its international use are anticipated to support this trend. Some projections estimate that the exchange rate could reach approximately 5.8 RMB per USD by 2025.

Implications for Businesses and Investors

Fluctuations in the US-RMB exchange rate can have significant implications for businesses and investors:

Businesses

1. Imports and Exports: A weaker RMB makes Chinese exports cheaper and US imports more expensive, potentially benefiting Chinese exporters. Conversely, a stronger RMB increases the cost of Chinese exports and reduces the price of US imports, benefiting US exporters.

2. Investment Returns: Companies investing in China may face currency risks if the RMB depreciates, leading to a decline in the value of their investments. On the other hand, a stronger RMB can enhance investment returns.

Investors

1. Currency Trading: Investors can capitalize on fluctuations in the exchange rate by engaging in currency trading. However, it is important to note that currency trading involves significant risk.

2. Asset Allocation: Investors may adjust their asset allocation strategies to manage currency risk. For example, they may invest in Chinese assets to hedge against a potential RMB appreciation.

Strategies for Managing Currency Risk

Businesses and investors can adopt various strategies to manage currency risk:

1. Hedging: Using financial instruments such as forwards, futures, or options to lock in an exchange rate for future transactions.

2. Diversification: Investing in a range of currencies to reduce exposure to fluctuations in any single currency.

3. Natural Hedging: Matching assets and liabilities denominated in different currencies to mitigate currency effects.

Tips and Tricks for Success

1. Stay Informed: Monitor economic indicators, news, and geopolitical events that may impact the US-RMB exchange rate.

2. Use Professional Advice: Consult with financial experts to develop tailored strategies for managing currency risk.

3. Patience and Discipline: Currency fluctuations can be volatile and unpredictable. It is crucial to remain patient and disciplined in managing currency exposure.

4. Embrace New Technologies: Explore innovative solutions like currency aggregation platforms to streamline currency management processes and reduce costs.

Table 1: Historical US-RMB Exchange Rates

| Year | Exchange Rate (RMB per USD) |

|---|---|

| 2010 | 6.83 |

| 2015 | 6.22 |

| 2020 | 6.92 |

Table 2: Projected US-RMB Exchange Rates for 2025

| Scenario | Exchange Rate (RMB per USD) |

|---|---|

| Optimistic | 5.4 |

| Moderate | 5.8 |

| Pessimistic | 6.2 |

Table 3: Strategies for Managing Currency Risk

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to lock in an exchange rate |

| Diversification | Investing in a range of currencies |

| Natural Hedging | Matching assets and liabilities in different currencies |

Table 4: Tips for Success in Currency Management

| Tip | Description |

|---|---|

| Stay Informed | Monitor economic indicators and news |

| Use Professional Advice | Consult with financial experts |

| Patience and Discipline | Remain patient and disciplined in managing exposure |

| Embrace New Technologies | Explore innovative solutions for currency management |

Conclusion

The US-RMB exchange rate is a dynamic and complex indicator that is influenced by a myriad of factors. By understanding the historical trends, projections for the future, and implications for businesses and investors, it is possible to develop effective strategies for managing currency risk. As we approach 2025, staying informed, using professional advice, and embracing new technologies will be key to navigating the challenges and opportunities associated with fluctuations in the US-RMB exchange rate.