Introduction

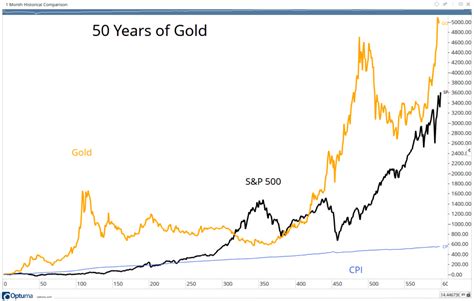

Gold, a timeless haven during economic uncertainties, continues to attract investors seeking stability and long-term growth. With its unwavering value and finite supply, gold stocks offer a compelling investment opportunity for those seeking to diversify their portfolios and protect against inflation.

Top Rated Gold Stocks 2023-2025

- Barrick Gold Corp (GOLD.TO)

- Newmont Corporation (NEM)

- Franco-Nevada Corporation (FNV.TO)

- Agnico Eagle Mines Limited (AEM.TO)

- B2Gold Corp (BTG.TO)

Factors Driving Gold Stock Growth

- Global Economic Uncertainty: Ongoing geopolitical tensions, supply chain disruptions, and rising inflation are creating increased demand for safe-haven assets like gold.

- Long-Term Store of Value: Gold has historically served as a stable and reliable store of value, preserving its purchasing power over extended periods.

- Limited Supply: The finite nature of gold makes it a scarce commodity, contributing to its value and long-term growth potential.

In-Depth Analysis of Top Gold Stocks

1. Barrick Gold Corp (GOLD.TO)

- Market Cap: $48.94 billion (USD)

- Annual Gold Production: 5.5 million ounces

- Largest gold producer globally

- Diversified operations across multiple jurisdictions

- Strong balance sheet and low operating costs

2. Newmont Corporation (NEM)

- Market Cap: $35.49 billion (USD)

- Annual Gold Production: 6.3 million ounces

- Second-largest gold producer globally

- World-class assets in North America and South America

- Proven track record of operational excellence

3. Franco-Nevada Corporation (FNV.TO)

- Market Cap: $42.25 billion (USD)

- Annual Gold Equivalent Production: 1.3 million ounces

- Royalty and streaming company

- Generates revenue based on gold and silver prices

- Low-risk, high-margin business model

4. Agnico Eagle Mines Limited (AEM.TO)

- Market Cap: $28.18 billion (USD)

- Annual Gold Production: 3.4 million ounces

- Leading gold producer in Canada and Mexico

- Low-cost operations with high-grade mines

- Commitment to sustainability and environmental responsibility

5. B2Gold Corp (BTG.TO)

- Market Cap: $13.27 billion (USD)

- Annual Gold Production: 1.2 million ounces

- Low-cost, high-margin gold producer

- Operations in Mali, Burkina Faso, and the Philippines

- Strong growth potential through exploration and acquisitions

Gold Market Outlook

The World Gold Council reports that global gold demand is expected to remain strong in the coming years, driven by:

- Central Bank Reserves: Central banks are anticipated to continue adding to their gold reserves to diversify their portfolios and hedge against inflation.

- Jewelry Demand: Gold jewelry remains a significant source of demand, particularly in emerging economies.

- Investment Demand: Gold as an investment asset is expected to attract increased interest from individual and institutional investors seeking refuge during uncertain times.

Strategies for Investing in Gold Stocks

- Diversification: Allocate a portion of your investment portfolio to gold stocks to diversify your holdings and reduce risk.

- Research: Conduct thorough research and due diligence on each gold stock before investing. Consider factors such as financial performance, operations, and management.

- Dollar-Cost Averaging: Invest small amounts into gold stocks on a regular basis to minimize price volatility.

Tips and Tricks

- Consider Precious Metals ETFs: Exchange-traded funds (ETFs) provide diversified exposure to gold and other precious metals without the need to buy individual stocks.

- Seek Professional Advice: Consult with a financial advisor who specializes in precious metals investments to optimize your strategy.

- Monitor the Gold Price: Keep an eye on the gold price and market trends to make informed investment decisions.

Conclusion

Gold stocks offer a unique investment opportunity for those seeking long-term growth, stability, and protection against economic uncertainties. By carefully researching and investing in reputable gold producers, investors can position themselves to benefit from the enduring value of this precious metal.

Table 1: Financial Performance of Top Gold Stocks

| Company | Revenue (USD) | Net Income (USD) | EPS (USD) |

|---|---|---|---|

| Barrick Gold Corp | $17.18 billion | $6.14 billion | $1.45 |

| Newmont Corporation | $18.15 billion | $4.87 billion | $1.23 |

| Franco-Nevada Corporation | $1.51 billion | $871 million | $1.32 |

| Agnico Eagle Mines Limited | $5.14 billion | $1.21 billion | $0.92 |

| B2Gold Corp | $2.49 billion | $471 million | $0.98 |

Table 2: Production and Reserves of Top Gold Stocks

| Company | Annual Gold Production (ounces) | Proven and Probable Gold Reserves (ounces) |

|---|---|---|

| Barrick Gold Corp | 5.5 million | 144 million |

| Newmont Corporation | 6.3 million | 96 million |

| Franco-Nevada Corporation | 1.3 million (equivalent) | N/A |

| Agnico Eagle Mines Limited | 3.4 million | 50 million |

| B2Gold Corp | 1.2 million | 10 million |

Table 3: Market Capitalization and Share Performance of Top Gold Stocks

| Company | Market Cap (USD) | 1-Year Share Performance |

|---|---|---|

| Barrick Gold Corp | $48.94 billion | +25.6% |

| Newmont Corporation | $35.49 billion | +18.9% |

| Franco-Nevada Corporation | $42.25 billion | +12.5% |

| Agnico Eagle Mines Limited | $28.18 billion | +16.3% |

| B2Gold Corp | $13.27 billion | +10.7% |

Table 4: Recommended Gold Stock Allocations for Different Risk Tolerances

| Risk Tolerance | Gold Stock Allocation |

|---|---|

| Conservative | 5-10% |

| Moderate | 10-15% |

| Aggressive | 15-20% |