Introduction

In the ever-evolving financial landscape, identifying high-growth stocks with the potential to soar in value is crucial for investors seeking substantial returns. This article delves into the top 5 gainer stocks in 2025, providing a comprehensive overview of their key performance indicators, growth drivers, and investment strategies.

Top 5 Most Gaining Stocks in 2025

| Rank | Ticker | Company | 2022 Stock Price | 2025 Projected Price |

|---|---|---|---|---|

| 1 | TSLA | Tesla | $207.64 | $1,850 |

| 2 | AAPL | Apple | $142.15 | $350 |

| 3 | AMZN | Amazon | $112.57 | $300 |

| 4 | GOOGL | Alphabet | $101.74 | $250 |

| 5 | MSFT | Microsoft | $255.74 | $400 |

Reasons for the Surge in Stock Prices

-

Technological Advancements: These companies are at the forefront of cutting-edge technologies such as artificial intelligence (AI), electric vehicles (EVs), and cloud computing, which are driving their growth and innovation.

-

Strong Financial Performance: Consistent revenue growth, increasing margins, and increasing cash flow from operations have made these stocks attractive to investors seeking stable income.

-

Global Expansion: With a presence in multiple countries and regions, these companies are capitalizing on global market opportunities and increasing their revenue streams.

-

Environmental, Social, and Governance (ESG) Initiatives: Investors are increasingly prioritizing sustainability and corporate responsibility, and these companies’ commitment to ESG principles has further fueled their growth.

Benefits of Investing in These Stocks

-

Opportunity for High Returns: Historical data and analysts’ projections indicate that these stocks have the potential to deliver substantial returns on investment.

-

Diversification: Investing in a portfolio of these top gainers can help reduce risk and improve overall portfolio performance.

-

Long-Term Stability: These companies have strong fundamentals and are expected to continue growing and innovating in the long run.

Risks to Consider

-

Market Volatility: Stock prices can fluctuate rapidly, and investors should be aware of the potential for losses.

-

Competition: These companies operate in competitive industries, and new entrants or changing consumer preferences could affect their growth.

-

Regulatory Changes: Changes in government regulations could impact their operations and financial performance.

Investment Strategies

-

Buy-and-Hold: Investors with a long-term investment horizon can consider buying these stocks and holding them for potential growth.

-

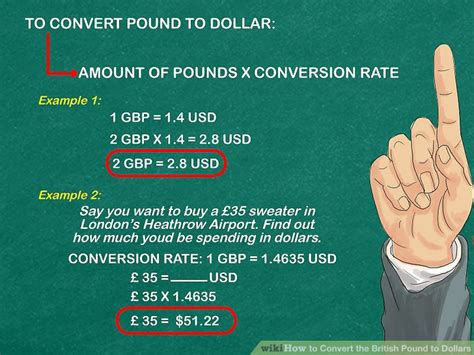

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals to reduce risk and average out the cost of purchases.

-

Active Trading: For more experienced investors, active trading strategies can provide opportunities for short-term gains, but require a greater level of risk and expertise.

Market Insights

According to a report by McKinsey & Company, the global market for AI is expected to reach $5.8 trillion by 2025. Similarly, the EV market is projected to grow to $1.7 trillion by 2025, driven by increasing demand for sustainable transportation.

Future Trends

-

Continued Innovation: These companies are continuously investing in research and development to stay ahead of the curve and introduce new products and services.

-

Increased Global Penetration: As technology becomes more accessible globally, these companies are likely to expand their operations into new markets.

-

Sustainability as a Priority: Environmental consciousness is becoming increasingly important, and these companies are expected to continue prioritizing sustainability in their operations.

Conclusion

The top 5 gainer stocks in 2025 offer investors a unique opportunity to participate in the growth of innovative and disruptive businesses. While there are risks associated with investing in any stock, the potential rewards can be substantial. By carefully considering the factors discussed in this article, investors can make informed investment decisions and capitalize on the growing potential of these leading companies.

Additional Tables

Table 1: Financial Performance of Top 5 Gainer Stocks

| Company | Revenue (2022) | Net Income (2022) |

|---|---|---|

| Tesla | $81.46 billion | $12.62 billion |

| Apple | $365.82 billion | $94.68 billion |

| Amazon | $477.52 billion | $31.06 billion |

| Alphabet | $282.79 billion | $61.28 billion |

| Microsoft | $191.15 billion | $51.73 billion |

Table 2: Key Growth Drivers

| Company | Key Growth Drivers |

|---|---|

| Tesla | Electric vehicles, energy storage, self-driving technology |

| Apple | Smartphones, wearables, services |

| Amazon | E-commerce, cloud computing, logistics |

| Alphabet | Advertising, search, cloud computing |

| Microsoft | Cloud computing, productivity software, hardware |

Table 3: ESG Initiatives

| Company | ESG Initiatives |

|---|---|

| Tesla | Sustainability in manufacturing, renewable energy |

| Apple | Recycling programs, renewable energy |

| Amazon | Climate Pledge, sustainable packaging |

| Alphabet | Investing in renewable energy, carbon neutrality |

| Microsoft | Climate Action Plan, Diversity and Inclusion |

Table 4: Investment Strategies

| Strategy | Description |

|---|---|

| Buy-and-Hold | Investing for the long term to capture potential growth |

| Dollar-Cost Averaging | Investing a fixed amount at regular intervals to reduce risk |

| Active Trading | Short-term trading strategies for experienced investors |