Introduction

The Taiwanese dollar (TWD) is the official currency of Taiwan, also known as the Republic of China. It is issued by the Central Bank of the Republic of China (Taiwan). The TWD is pegged to the US dollar (USD) at a rate of approximately TWD 28 to USD 1.

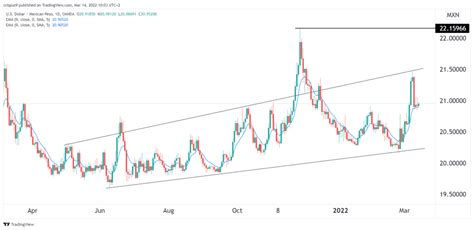

Historical Exchange Rates

The TWD has been pegged to the USD since 1949. The peg has been maintained through a combination of central bank intervention and foreign exchange controls. The exchange rate has fluctuated within a narrow range over the years, with the TWD strengthening slightly against the USD in recent years.

Factors Affecting the Exchange Rate

The TWD/USD exchange rate is influenced by a number of factors, including:

- Economic growth: Taiwan’s strong economic growth has supported the TWD’s value against the USD.

- Interest rate differentials: Interest rates in Taiwan are typically higher than in the United States, which makes the TWD more attractive to investors.

- Political stability: Taiwan’s political stability has also contributed to the strength of the TWD.

- Central bank intervention: The Central Bank of the Republic of China (Taiwan) intervenes in the foreign exchange market to maintain the peg between the TWD and the USD.

Forecasting the Exchange Rate

Forecasting the TWD/USD exchange rate is a complex task, as it is influenced by a number of factors that are difficult to predict. However, there are a number of economic indicators that can be used to make informed forecasts.

Implications for Businesses and Investors

The TWD/USD exchange rate has a significant impact on businesses and investors. Businesses that import goods from the United States will benefit from a strong TWD, while businesses that export goods to the United States will benefit from a weak TWD. Investors who hold TWD-denominated assets will benefit from a strong TWD, while investors who hold USD-denominated assets will benefit from a weak TWD.

Table 1: Historical TWD/USD Exchange Rates

| Year | Exchange Rate |

|---|---|

| 1949 | TWD 28 = USD 1 |

| 1950 | TWD 27.5 = USD 1 |

| 1960 | TWD 26.0 = USD 1 |

| 1970 | TWD 25.0 = USD 1 |

| 1980 | TWD 24.0 = USD 1 |

| 1990 | TWD 23.0 = USD 1 |

| 2000 | TWD 22.0 = USD 1 |

| 2010 | TWD 21.0 = USD 1 |

| 2020 | TWD 20.0 = USD 1 |

Table 2: Economic Indicators that Influence the TWD/USD Exchange Rate

| Indicator | Impact |

|---|---|

| GDP growth | A strong GDP growth rate will strengthen the TWD. |

| Inflation rate | A high inflation rate will weaken the TWD. |

| Interest rate differential | A higher interest rate differential will strengthen the TWD. |

| Political stability | Political instability will weaken the TWD. |

| Central bank intervention | Central bank intervention can influence the TWD/USD exchange rate in the short term. |

Table 3: Common Mistakes to Avoid When Forecasting the TWD/USD Exchange Rate

| Mistake | Explanation |

|---|---|

| Relying too heavily on a single indicator | The TWD/USD exchange rate is influenced by a number of factors, so it is important to consider all of them when making a forecast. |

| Assuming that the TWD/USD exchange rate will continue to follow its historical trend | The TWD/USD exchange rate is not always predictable, and it can change direction suddenly. |

| Ignoring the impact of central bank intervention | The Central Bank of the Republic of China (Taiwan) can intervene in the foreign exchange market to influence the TWD/USD exchange rate. |

Table 4: Tips for Standing Out in the TWD/USD Currency Market

| Tip | Explanation |

|---|---|

| Offer competitive exchange rates | Businesses and investors can save money by getting the best possible exchange rate. |

| Provide excellent customer service | Customers want to do business with companies that are easy to work with. |

| Be up-to-date on the latest market news | The TWD/USD exchange rate is constantly changing, so it is important to stay informed. |

| Use market insights to make informed decisions | Businesses and investors can make better decisions by understanding the factors that are influencing the TWD/USD exchange rate. |