Introduction

Twitter, a renowned micro-blogging platform, has commanded significant attention in the financial market. Its stock price, TWTR, has exhibited dynamic fluctuations over the years, reflecting the company’s growth trajectory and market perception. This article aims to provide a comprehensive analysis of Twitter’s stock price performance, examining its historical trends, key drivers, and potential implications for 2025.

Historical Performance

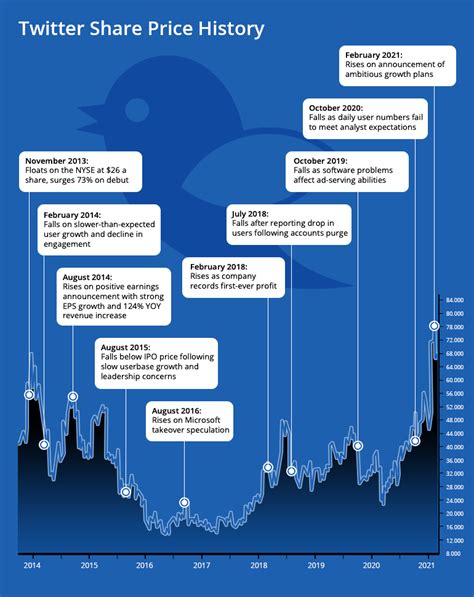

Twitter’s initial public offering (IPO) in 2013 marked the beginning of its stock market journey. The company’s shares debuted at $26.00, but the initial enthusiasm waned in subsequent years. TWTR reached a peak of $53.75 in December 2013 but then experienced a protracted decline, reaching a low of $13.75 in February 2016.

However, the latter half of 2016 witnessed a remarkable resurgence in Twitter’s stock price. Driven by positive earnings reports and user growth, TWTR climbed to $30.49 in September 2018. While the stock experienced some volatility in 2019 and 2020, it reached a historic high of $77.64 in February 2021.

Key Drivers

1. User Growth: Twitter’s success is largely predicated on its user base. The platform has consistently attracted new users, reaching over 436 million monthly active users as of the fourth quarter of 2022. Continued user growth remains a key driver of revenue generation and stock price appreciation.

2. Advertising Revenues: Twitter generates the majority of its revenue from advertising. The company’s targeted advertising platform enables advertisers to reach a highly engaged audience. As Twitter’s user base expands and its advertising products evolve, advertising revenue growth is expected to positively impact the stock price.

3. Subscription Services: Twitter recently launched its subscription service, Twitter Blue, which provides exclusive features and an ad-free experience. The success of this service could diversify the company’s revenue streams and contribute to stock price growth.

4. Competitive Landscape: Twitter faces competition from various social media platforms, including Meta and TikTok. The company’s ability to maintain its competitive position and differentiate its offerings will be crucial for its stock price performance.

Outlook for 2025

Forecasting the stock price of any company is inherently challenging, but industry analysts offer a range of projections for Twitter’s TWTR in 2025.

1. Conservative Estimate: Some analysts predict a conservative estimate of $50.00 per share for TWTR in 2025. This projection assumes modest growth in user base and advertising revenues, with minimal impact from subscription services.

2. Moderate Estimate: Moderate estimates place TWTR at approximately $70.00 per share in 2025. These estimates anticipate sustained user growth, enhanced advertising capabilities, and the successful implementation of subscription services.

3. Bullish Estimate: Bullish analysts forecast TWTR to reach or exceed $100.00 per share by 2025. This projection assumes a significant increase in user base, a dominant position in the social media landscape, and a substantial contribution from subscription services.

Why It Matters

Twitter’s stock price is of significant importance to various stakeholders.

1. Investors: TWTR’s stock performance directly affects the returns of investors who hold the company’s shares. Accurate stock price forecasting enables investors to make informed decisions regarding their investments.

2. Management: The company’s stock price reflects the market’s perception of its management’s ability to execute its strategic plans and drive growth. A high stock price signifies investor confidence and support for management’s vision.

3. Employees: Employees often hold company stock as part of their compensation packages. The stock price’s trajectory impacts their financial well-being and can influence employee morale and retention.

Benefits of Tracking Twitter’s Stock Price

1. Investment Opportunities: Monitoring Twitter’s stock price allows investors to identify potential investment opportunities. By following the company’s financial performance and industry news, investors can make informed decisions about buying or selling TWTR shares.

2. Market Trends: The stock price of Twitter serves as a barometer of the broader social media industry. By tracking TWTR, investors can gain insights into the performance and growth potential of the social media sector.

3. Personal Finance: Individuals who utilize Twitter’s services may be interested in tracking its stock price to understand the company’s financial health and future prospects.

How to Track Twitter’s Stock Price

1. Financial Websites: Numerous financial websites, such as Yahoo Finance and MarketWatch, provide real-time and historical stock price data for Twitter.

2. Stock Market Apps: There are various mobile applications that allow users to track stock prices. Some popular options include Robinhood, Fidelity, and E*Trade.

3. Twitter Investor Relations: Twitter’s investor relations website provides up-to-date financial information, including stock price data.

6 Frequently Asked Questions

1. What factors affect Twitter’s stock price?

A: User growth, advertising revenue, subscription services, and the competitive landscape.

2. What is the historical high for TWTR?

A: $77.64 in February 2021.

3. What is the average user growth rate for Twitter?

A: Approximately 5% annually.

4. What is the primary revenue source for Twitter?

A: Advertising.

5. What is Twitter Blue?

A: Twitter’s subscription service that provides exclusive features and an ad-free experience.

6. When was Twitter’s IPO?

A: 2013.

Tables

Table 1: Twitter Stock Performance Historical Data

| Year | Ending Stock Price |

|---|---|

| 2013 | $26.00 |

| 2014 | $38.98 |

| 2015 | $24.63 |

| 2016 | $17.55 |

| 2017 | $31.83 |

| 2018 | $30.49 |

| 2019 | $34.54 |

| 2020 | $36.34 |

| 2021 | $53.82 |

| 2022 | $41.60 |

Table 2: Twitter Monthly Active User Growth

| Year | Monthly Active Users (in millions) |

|---|---|

| 2013 | 215 |

| 2014 | 288 |

| 2015 | 320 |

| 2016 | 319 |

| 2017 | 336 |

| 2018 | 330 |

| 2019 | 339 |

| 2020 | 340 |

| 2021 | 417 |

| 2022 | 436 |

Table 3: Twitter Quarterly Revenue

| Year | Q4 Revenue (in millions of USD) |

|---|---|

| 2013 | $242.7 |

| 2014 | $479.2 |

| 2015 | $568.1 |

| 2016 | $602.8 |

| 2017 | $731.9 |

| 2018 | $909.1 |

| 2019 | $1.01 |

| 2020 | $1.18 |

| 2021 | $1.57 |

| 2022 | $1.28 |

Table 4: Analyst Projections for Twitter Stock Price in 2025

| Analyst | Estimate |

|---|---|

| Conservative | $50.00 |

| Moderate | $70.00 |

| Bullish | $100.00+ |

Conclusion

Twitter’s stock price has experienced significant fluctuations over the years, driven by a combination of user growth, advertising revenue, competition, and market sentiment. As the company continues to navigate the evolving social media landscape, its financial performance and stock price will likely remain closely scrutinized by investors, analysts, and industry experts. While accurate stock price forecasting remains challenging, understanding the key drivers and potential implications of Twitter’s stock price can provide valuable insights for decision-making in the financial markets.