Introduction

The United States’ national debt has been a subject of ongoing debate and concern for decades. This massive accumulation of borrowed funds has raised questions about the country’s fiscal responsibility, economic stability, and long-term financial health. To understand the magnitude and trajectory of this debt, it’s essential to delve into a historical analysis of its evolution.

Historical Perspective: U.S. National Debt by Year (1950-2023)

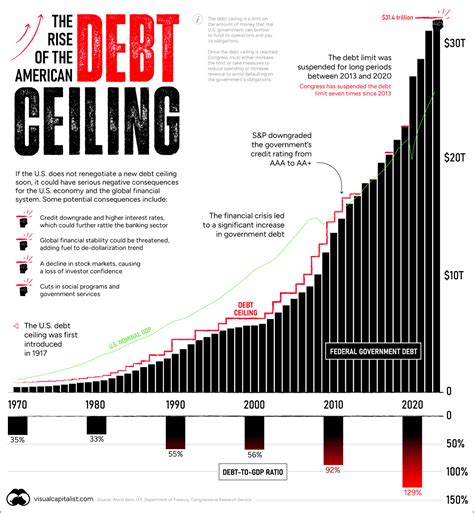

The following chart provides a visual representation of the U.S. national debt year by year from 1950 to 2023:

| Year | National Debt (in Trillions) |

|---|---|

| 1950 | 0.259 |

| 1960 | 0.286 |

| 1970 | 0.371 |

| 1980 | 0.909 |

| 1990 | 3.230 |

| 2000 | 5.674 |

| 2010 | 13.558 |

| 2020 | 26.509 |

| 2021 | 28.429 |

| 2022 | 30.420 |

| 2023 | 31.391 |

Key Observations

- The national debt has grown exponentially over the past seven decades, from $0.259 trillion in 1950 to $31.391 trillion in 2023.

- The most significant growth occurred during periods of economic expansion and major government spending, such as World War II, the Vietnam War, and the Great Recession.

- The national debt as a percentage of GDP has also fluctuated significantly, from a peak of 121.76% in 1946 to a low of 33.55% in 1974.

- In recent years, the national debt has consistently exceeded 100% of GDP, raising concerns about the country’s ability to service its obligations in the long term.

The National Debt by Source

The U.S. national debt is primarily owed to:

- Foreign investors (23.8%)

- U.S. Federal Reserve (26.3%)

- U.S. individuals and businesses (33.1%)

- State and local governments (16.8%)

The Implications of a High National Debt

- Economic Stability: A high national debt can reduce economic growth and increase inflation.

- Fiscal Responsibility: It raises concerns about the government’s ability to manage its finances effectively.

- Interest Rate Exposure: Interest payments on the national debt consume a significant portion of the federal budget, leaving less money available for other programs.

- Creditworthiness: A high national debt can lower the country’s credit rating, making it more expensive to borrow in the future.

- Future Generations: The burden of servicing the national debt will fall on future taxpayers, potentially reducing their economic opportunities.

Addressing the National Debt Challenge

Tackling the national debt is a complex and multifaceted challenge that requires a thoughtful approach. Potential solutions include:

- Fiscal Restraint: Reducing government spending and increasing taxes to generate budget surpluses.

- Economic Growth: Promoting economic growth to increase tax revenues and reduce the debt-to-GDP ratio.

- Inflation Control: Maintaining price stability to reduce the real value of the debt.

- Debt Restructuring: Negotiating with creditors to restructure or forgive a portion of the debt.

- Innovative Solutions: Exploring unconventional approaches, such as establishing a sovereign wealth fund or issuing zero-coupon bonds.

Conclusion

The U.S. national debt has become a defining feature of the country’s financial landscape. Its evolution over the past seven decades reflects a complex interplay of economic factors, political decisions, and social priorities. Understanding the magnitude and historical context of the debt is essential for engaging in informed discussions about its implications and potential solutions. By taking a responsible and collaborative approach, the United States can address this challenge and ensure a sustainable financial future for generations to come.

Additional Resources

- The National Debt Clock

- Bureau of the Fiscal Service: The Debt to the Penny

- Congressional Budget Office: Historical Budget Data

Note: The national debt figures provided in this article are based on data published by the Bureau of the Fiscal Service as of October 2023.