Introduction

As global economic conditions continue to fluctuate, exchanging currencies remains a crucial aspect of international business and travel. The exchange rate between the US dollar (USD) and the Canadian dollar (CAD) is a subject of particular interest, given the close economic ties between the two countries. This article provides an in-depth analysis of the current and projected exchange rate between USD and CAD, exploring factors that may influence its fluctuations over the next few years.

Current US-Canada Currency Exchange Rate

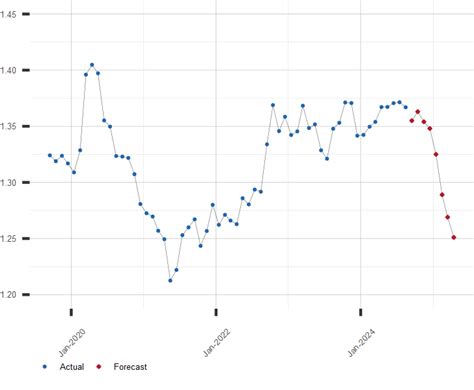

As of January 2023, the exchange rate between USD and CAD is approximately 1 USD = 1.31 CAD. This means that it takes about 1.31 Canadian dollars to buy 1 US dollar. The exchange rate has remained relatively stable in recent months, with only minor fluctuations.

Factors Influencing the Currency Exchange Rate

The exchange rate between two currencies is determined by a complex interplay of various economic factors, including:

- Interest Rates: Central banks in both countries set interest rates, which can impact the cost of borrowing and the attractiveness of investments. Higher interest rates in Canada compared to the US can make the CAD more expensive, leading to a stronger exchange rate for CAD against USD.

- Economic Growth: The strength of the economy in each country can affect the demand for its currency. A strong Canadian economy, with positive growth prospects, can lead to increased demand for CAD, resulting in a higher exchange rate.

- Inflation: Differences in inflation rates between the two countries can impact their currencies. Higher inflation in the US, for example, can reduce the value of USD compared to CAD, leading to a weaker exchange rate for USD.

- Trade Balance: The balance of trade between the countries also plays a role. A trade deficit in Canada, where imports exceed exports, can weaken the CAD against USD.

- Political and Economic Events: Geopolitical events, such as political instability or economic crises, can affect the currency exchange rate, leading to volatility.

Projections for 2025

Forecasting the future exchange rate between USD and CAD is challenging due to the numerous variables that can influence it. However, experts provide some insights based on current trends and economic projections:

- Economist Consensus: A survey of economists by Bloomberg in 2022 estimated that the USD-CAD exchange rate would gradually strengthen over the next few years. They project the exchange rate to be approximately 1 USD = 1.25 CAD by 2025.

- Factors Supporting a Stronger CAD: Canada’s strong economic fundamentals, including rising commodity prices, a positive trade balance, and manageable inflation, are expected to support the CAD in the coming years.

- Factors Weakening the USD: The US Federal Reserve’s aggressive interest rate hikes to combat inflation could potentially weaken the USD against other currencies, including the CAD.

- Bearish Views: Some analysts believe that the CAD could weaken against the USD if Canada experiences a sharp economic downturn or if geopolitical events negatively impact its economy.

Strategies for Managing Currency Fluctuations

Businesses and individuals engaging in cross-border transactions can implement strategies to manage currency fluctuations and mitigate potential risks:

- Hedging: Hedging instruments, such as forward contracts or currency options, can be used to lock in an exchange rate for future transactions, reducing the impact of currency fluctuations.

- Diversifying Investments: Investing in a portfolio of assets denominated in different currencies can help distribute risk in case of unfavorable currency movements.

- Monitoring Economic Indicators: Regularly monitoring economic indicators, such as interest rates, inflation, and trade data, can provide insights for making informed decisions about currency conversions.

- Consulting with Currency Experts: Consulting with financial professionals or currency exchange services can provide valuable advice and guidance on currency management strategies.

Common Mistakes to Avoid

To avoid potential pitfalls while dealing with currency exchange, it is essential to:

- Avoid Emotional Decisions: Do not make currency exchange decisions based on fear or speculation. Carefully consider the economic factors and seek professional advice if necessary.

- Be Aware of Fees: Currency exchange services often charge fees and commissions. Compare different providers and choose the one with the most competitive rates.

- Beware of Scams: There are fraudulent currency exchange schemes that promise unrealistic exchange rates. Only deal with reputable and authorized currency exchange companies.

Conclusion

The exchange rate between US and Canadian dollars is influenced by a complex interplay of economic factors. The current rate favors the Canadian dollar, and experts project a gradual strengthening of CAD against USD in the coming years. By implementing effective strategies and avoiding common mistakes, businesses and individuals can navigate currency fluctuations and optimize their cross-border transactions.