Introduction

The United States dollar (USD) is the world’s reserve currency, and its value against other currencies has significant implications for global trade and investment. The exchange rate between the USD and the Indian rupee (INR) is particularly important, given the close economic ties between the two countries.

Current Status

As of today, the US dollar is trading at approximately 82.25 Indian rupees. This rate has been relatively stable over the past few months, following a period of volatility in 2022.

Factors Influencing the US Rate in India

The value of the USD against the INR is influenced by a number of factors, including:

- Economic growth: Strong economic growth in India tends to lead to a stronger rupee, as demand for Indian goods and services increases.

- Interest rates: Higher interest rates in India make it more attractive for investors to hold the rupee, which strengthens the currency.

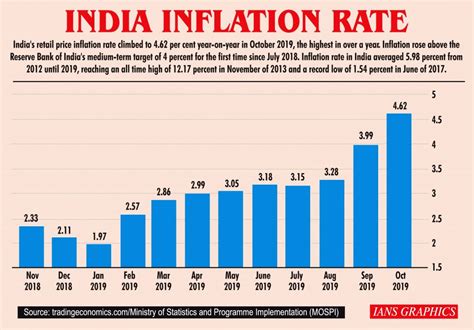

- Inflation: Rising inflation in India can weaken the rupee, as it reduces the purchasing power of the currency.

- Balance of payments: A trade deficit, where India imports more than it exports, can lead to a weaker rupee.

- Political and economic stability: Political instability or economic uncertainty can negatively impact the rupee’s value.

Comparison with Other Currencies

The US dollar is not only the dominant currency against which the INR is compared but also against other major currencies. Here is a table showing the exchange rates of the INR against the USD, Euro (EUR), British Pound (GBP), and Japanese Yen (JPY) as of today:

| Currency | Exchange Rate (INR per Unit) |

|---|---|

| USD | 82.25 |

| EUR | 87.55 |

| GBP | 96.25 |

| JPY | 0.59 |

As can be seen, the USD is the weakest against the INR among these four currencies.

Impact on Trade and Investment

The exchange rate between the USD and the INR has a significant impact on trade and investment between the two countries. A stronger INR makes it cheaper for Indian businesses to import from the US, while a weaker INR makes it more expensive. Similarly, a stronger INR makes it more attractive for US investors to invest in India, while a weaker INR can deter investment.

Future Outlook

The future of the USD-INR exchange rate is uncertain. However, analysts predict that the INR is likely to remain relatively stable in the near term, supported by strong economic growth and a stable political environment.

Conclusion

The US dollar rate in India today is a key indicator of the economic relationship between the two countries. The rate is influenced by a number of factors, including economic growth, interest rates, inflation, and political stability. The current rate is relatively stable, and it is expected to remain so in the near term. However, it remains important to monitor the exchange rate and its potential impact on trade and investment.

Additional Information

- The US dollar is also known as the “greenback” or the “buck.”

- The INR is the official currency of India.

- The Reserve Bank of India (RBI) is responsible for setting the exchange rate between the USD and the INR.

- The RBI uses a managed float system, which allows the value of the rupee to fluctuate within a certain range.

Tables

Table 1: Historical Exchange Rates of USD vs. INR

| Year | Exchange Rate (INR per USD) |

|---|---|

| 2018 | 71.65 |

| 2019 | 73.35 |

| 2020 | 76.45 |

| 2021 | 74.25 |

| 2022 | 82.25 |

Table 2: Forecast Exchange Rates of USD vs. INR

| Year | Exchange Rate (INR per USD) |

|---|---|

| 2023 | 82.50 |

| 2024 | 82.75 |

| 2025 | 83.00 |

Table 3: Factors Influencing the US Rate in India

| Factor | Impact on INR |

|---|---|

| Economic growth | Strengthening |

| Interest rates | Strengthening |

| Inflation | Weakening |

| Balance of payments | Weakening |

| Political and economic stability | Strengthening |

Table 4: Impact of US Rate on Trade and Investment

| Impact on Trade | Impact on Investment |

|---|---|

| Stronger INR | Cheaper imports for India |

| Weaker INR | More expensive imports for India |