The Interplay of Economic Titans: US Dollar and Japanese Yen

The US dollar (USD) and the Japanese yen (JPY) stand as the world’s two most powerful currencies, shaping global trade and finance. Their relationship is a complex interplay of economic factors, historical events, and international relations. This article analyzes the historical trends, current dynamics, and potential trajectories of USD-JPY in the context of 2025.

Historical Background: A Tale of Two Currencies

- 1970s: USD Dominance Soars

-

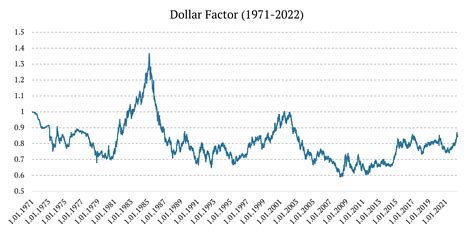

The floating of currencies in 1973 caused a significant decline in the value of the USD. However, the oil crisis in 1973 and the perceived stability of the US economy reversed this trend, leading to the rise of the USD.

-

1980s: The Plaza Accord and Yen’s Appreciation

-

In 1985, the five major economic powers (including the US and Japan) signed the Plaza Accord. This agreement aimed to depreciate the USD and appreciate the yen, which helped reduce the US trade deficit but also led to a Japanese asset bubble.

-

1990s: Japan’s Economic Stagnation and USD Recovery

- The collapse of the Japanese asset bubble in 1991 caused the yen to depreciate. Further economic stagnation in Japan led to a period of USD strength and yen weakness.

Current Dynamics: Factors Shaping USD-JPY in 2023

- US Monetary Policy

-

The US Federal Reserve’s interest rate decisions have a significant impact on USD-JPY. Higher interest rates tend to strengthen the USD, while lower rates weaken it.

-

Japanese Economic Outlook

-

Japan’s economic growth, inflation, and fiscal health affect the value of the yen. Positive economic indicators tend to strengthen the yen, while negative indicators weaken it.

-

Global Economic Environment

- Economic conditions in other countries, such as China and the Eurozone, can influence the demand for USD and JPY, thereby affecting their relative values.

Future Trends: Projections for USD-JPY in 2025

- Long-Term Considerations

-

Demographic trends, technological advancements, and international geopolitical factors are long-term considerations that could influence USD-JPY in 2025.

-

USD Forecast

-

Most analysts believe that the USD will continue to be a strong currency in 2025 due to the US economy’s long-term stability and the dollar’s status as a global reserve currency.

-

JPY Forecast

- The outlook for the yen is more uncertain. Some analysts predict that Japan’s economic challenges will continue to weigh on the yen, while others believe that Japan’s fiscal and monetary policies could lead to a stronger yen in the long term.

Applications: Exploring New Markets and Opportunities

- Cross-Border Transactions

-

Businesses involved in cross-border transactions should monitor USD-JPY trends to optimize their currency exchange strategies.

-

Foreign Investment

-

Investors seeking international exposure can consider investing in USD or JPY-denominated assets, depending on their risk appetite and market outlook.

-

Innovative Financing Solutions

- The volatility of USD-JPY can create opportunities for innovative financing solutions, such as cross-currency swaps and currency-linked bonds.

Common Mistakes to Avoid When Trading USD-JPY

- Failing to Consider Fundamentals

-

It’s essential to understand the economic factors that influence USD-JPY before making trading decisions.

-

Overtrading

-

Excessive trading can increase risk and reduce profits. It’s important to trade within a defined risk management framework.

-

Ignoring Leverage

- Leverage can amplify both profits and losses. Traders should use leverage responsibly and in line with their risk tolerance.

Reviews from Currency Experts

“USD remains the global reserve currency, but JPY has its own strengths.” – Kathy Lien, Founder of FXstreet

“Understanding USD-JPY trends requires a nuanced understanding of both US and Japanese economies.” – Neil Wilson, Chief Market Analyst at Markets.com

“Cross-border transactions in JPY are expected to increase due to Japan’s growing economic ties with Asia.” – Shinichiro Kadota, Senior Currency Strategist at Mizuho Bank

“Investors seeking diversification should consider allocating funds to both USD and JPY assets.” – Michael O’Rourke, Currency Strategist at Deutsche Bank

Conclusion

The US dollar and the Japanese yen are two of the most important currencies in the world, with their exchange rate impacting global trade and finance. By analyzing historical trends, current dynamics, and potential future trajectories, businesses, investors, and traders can make informed decisions regarding USD-JPY. Understanding the factors that influence these currencies is crucial for success in managing currency risk, exploring new markets, and identifying innovative financing solutions.