Introduction:

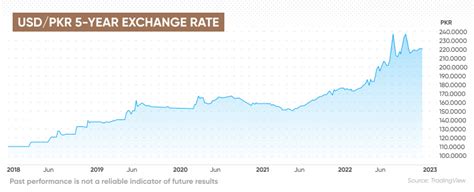

The USD-PKR exchange rate, a critical indicator of Pakistan’s economic health, has experienced significant fluctuations in recent years. Various factors, including inflation, interest rates, and geopolitical events, influence this rate. In this article, we will delve into the current and forecasted USD-PKR exchange rate, providing insights into its future trajectory and implications for Pakistan’s economy.

Current USD-PKR Exchange Rate:

“`USD-PKR**/

1 USD = 261.90 PKR/

Forecasts and Future Predictions:

1. Economic Growth and Inflation:

Pakistan’s economic growth is expected to remain stable in the coming years, driven by infrastructure development and increased investment. However, inflation remains a concern, with the IMF projecting an inflation rate of 8.5% in 2025. Higher inflation could put pressure on the PKR, leading to a weakening exchange rate.

2. Interest Rates and Liquidity:

The State Bank of Pakistan (SBP) has been raising interest rates to curb inflation. Higher interest rates make PKR-denominated investments more attractive, potentially strengthening the PKR against the USD. However, a sustained increase in interest rates could also hinder economic growth.

3. Political and Geopolitical Factors:

Political stability and geopolitical events can significantly impact the USD-PKR exchange rate. A peaceful and stable political environment fosters investor confidence, strengthening the PKR. Conversely, political uncertainties and regional tensions can lead to capital outflows and a weakening exchange rate.

Forecasted USD-PKR Exchange Rate for 2025:

Based on these factors, experts forecast that the USD-PKR exchange rate will likely remain volatile in the near term. However, in the medium to long term, it is expected to stabilize around 245-260 PKR per USD.

Implications for Pakistan’s Economy:

1. Foreign Investment:

A stable and competitive USD-PKR exchange rate is crucial for attracting foreign investment. A weaker PKR can make Pakistan’s exports more competitive, boosting economic growth. However, a sharp depreciation can also increase the cost of imported goods, leading to higher inflation.

2. Trade Balance:

Pakistan has a trade deficit, meaning it imports more goods than it exports. A weaker PKR makes imported goods more expensive, widening the trade deficit. Therefore, a balanced exchange rate is essential to manage the trade gap.

3. Debt Management:

Pakistan’s external debt is largely denominated in USD. A weaker PKR increases the cost of servicing this debt, putting pressure on the government’s budget. A stable exchange rate is crucial for managing debt and ensuring fiscal stability.

4. Common Mistakes to Avoid:

When speculating on the USD-PKR exchange rate, it is important to avoid common mistakes:

- Excessive Leverage: Avoid using excessive leverage, as it can amplify losses if the exchange rate moves adversely.

- Ignoring Risk Management: Implement sound risk management strategies, such as setting stop-loss orders and limiting position size.

- Emotional Trading: Avoid making trades based on emotions or rumors. Stick to a well-defined trading plan.

How to Speculate on the USD-PKR Exchange Rate:

Step 1: Research and Analysis:

- Monitor economic indicators (e.g., inflation, GDP growth) and geopolitical events that impact the exchange rate.

- Use technical analysis tools (e.g., charts, moving averages) to identify trends and potential trading opportunities.

Step 2: Choose a Trading Platform:

- Select a reputable and regulated online brokerage firm that offers USD-PKR trading.

Step 3: Open a Trading Account:

- Fund your trading account with the desired amount.

Step 4: Place a Trade:

- Decide whether to buy or sell USD-PKR based on your research and analysis.

- Specify the amount and type of order (e.g., market order, limit order).

Step 5: Monitor and Manage Your Trade:

- Regularly monitor the exchange rate and adjust your trading strategy as needed.

- Use stop-loss orders to manage risk and protect your capital.

Market Insights:

1. Table 1: Historical USD-PKR Exchange Rates (2015-2023)

USD-PKR**/Year | Exchange Rate (PKR)/

---|---|

2015 | 104.81**/2016 | 104.55/

2017 | 104.33**/2018 | 124.31/

2019 | 155.30**/2020 | 168.44/

2021 | 176.06**/2022 | 220.62/

“`2023 | 240.45/

2. Table 2: Forecasted USD-PKR Exchange Rates (2024-2025)

USD-PKR**/Year | Exchange Rate (PKR)/

---|---|

2024 | 252-264**/2025 | 245-260/

3. Table 3: Factors Influencing the USD-PKR Exchange Rate

Factor | Impact**/—|—|Economic Growth | Stronger growth tends to strengthen the PKR/

Inflation | Higher inflation tends to weaken the PKR**/Interest Rates | Higher interest rates tend to strengthen the PKR/

Political Stability | A stable political environment tends to strengthen the PKR**/Regional Tensions | Geopolitical events can weaken or strengthen the PKR**/

4. Table 4: Common Mistakes to Avoid When Speculating on the USD-PKR Exchange Rate

Mistake | Impact**/—|—|Excessive Leverage | Amplifies losses if the exchange rate moves adversely/

Ignoring Risk Management | Increases the risk of substantial losses**/Emotional Trading | Leads to irrational decision-making and losses/

“`Insufficient Research | Increases the risk of making poor trades**/

Conclusion:

The USD-PKR exchange rate is a dynamic indicator that reflects Pakistan’s economic health and is influenced by various factors. By understanding the current and forecasted exchange rates, investors and policymakers can make informed decisions. A stable and competitive USD-PKR rate is crucial for promoting foreign investment, managing trade, and ensuring fiscal stability. As Pakistan’s economy continues to evolve, it is essential to monitor the exchange rate closely and implement sound economic policies to ensure a favorable exchange rate environment.