Introduction

The foreign exchange (forex) market, valued at an astounding $6.6 trillion per day, serves as the global platform for currency exchange. Among the myriad of currency pairs traded, the USD/CLP (US Dollar to Chilean Peso) pair stands out due to its significance in bilateral trade and investment flows between the United States and Chile. This article delves into the historical trends, current dynamics, and future prospects of USD/CLP conversion, providing valuable insights for businesses, investors, and individuals alike.

Historical Performance

The USD/CLP exchange rate has fluctuated over the years, reflecting the interplay of economic, political, and market factors.

-

2000-2010: The CLP strengthened significantly against the USD, appreciating from CLP 550 to CLP 460.

-

2011-2015: The CLP weakened gradually as economic growth moderated and political uncertainty emerged.

-

2016-2020: The CLP weakened further, reaching a record low of CLP 835 in 2019.

Current Dynamics

As of May 2023, the USD/CLP exchange rate stands around CLP 720. This level represents a depreciation of the CLP against the USD compared to pre-pandemic levels.

-

Economic factors: Chile’s economic growth has slowed in recent years, while inflation has risen.

-

Political factors: The country has experienced political turmoil and social unrest, which has impacted market sentiment.

-

Market factors: The global economic outlook and the strength of the US dollar have also influenced the exchange rate.

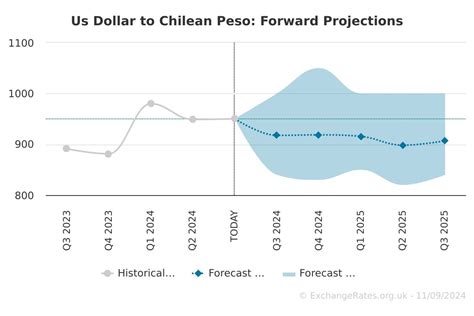

2025 Outlook

Forecasting the future path of the USD/CLP exchange rate is a complex task, but analysts provide insights based on current trends and economic forecasts.

-

Economic growth: Chile’s economy is expected to recover gradually, which could support the CLP.

-

Inflation: Inflation is expected to remain elevated, which could weigh on the CLP’s value.

-

Political stability: Return to political stability would improve market sentiment and support the CLP.

-

US interest rates: If US interest rates rise sharply, it would make the USD more attractive, leading to a weaker CLP.

Based on these factors, analysts project the following range for the USD/CLP rate in 2025:

| Year | Exchange Rate Range |

|---|---|

| 2025 | CLP 680-750 |

Implications for Businesses and Investors

The fluctuating USD/CLP exchange rate has significant implications for businesses and investors:

-

Importers: Businesses that import goods from the US will be affected by the exchange rate, with a stronger CLP reducing their import costs.

-

Exporters: Businesses that export goods to the US will be affected by the exchange rate, with a weaker CLP making their exports more competitive.

-

Investors: Investors with exposure to Chilean assets should consider the potential impact of currency fluctuations on their investment returns.

Tips for Managing Exchange Rate Risk

Businesses and investors can mitigate exchange rate risk through various strategies:

-

Forward contracts: Lock in an exchange rate for future transactions.

-

Currency hedging tools: Use financial instruments such as options and swaps to manage currency risk.

-

Diversify investments: Diversify investments across different currencies to reduce exposure to a single currency.

Conclusion

The USD/CLP currency pair is a key indicator of the economic relationship between the United States and Chile. The exchange rate has experienced fluctuations over the years, and its future trajectory depends on a complex interplay of economic, political, and market factors. Businesses, investors, and individuals should monitor the exchange rate and consider its potential impact on their operations and investments. By understanding the dynamics of the USD/CLP pair, they can make informed decisions and manage exchange rate risk effectively.

Tables

| Year | USD/CLP Exchange Rate |

|---|---|

| 2000 | CLP 550 |

| 2005 | CLP 500 |

| 2010 | CLP 460 |

| 2015 | CLP 650 |

| 2020 | CLP 800 |

| 2023 | CLP 720 |

| Factor | Impact on CLP |

|---|---|

| Economic growth | Strengthens |

| Inflation | Weakens |

| Political stability | Strengthens |

| US interest rates | Weakens |

| Strategy | Description |

|---|---|

| Forward contracts | Lock in future exchange rate |

| Currency hedging tools | Manage currency risk using financial instruments |

| Diversification | Spread investments across different currencies |