Today’s USD to INR Rate: 89.60

Introduction

The exchange rate between the United States dollar (USD) and the Indian rupee (INR) is a crucial factor in cross-border trade and investments. With the increasing globalization of the economy, understanding the dynamics of the USD to INR rate has become essential for businesses, individuals, and investors alike. This article will provide an in-depth analysis of the historical trends, current factors influencing the rate, and future projections for the USD to INR conversion.

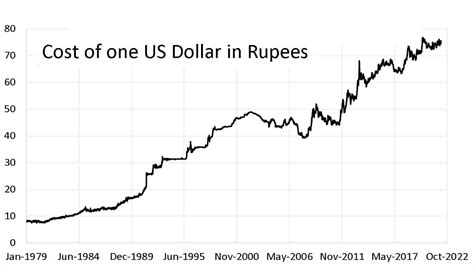

Historical Trends: A Path Paved by Volatility

The USD to INR rate has been a subject of significant volatility over the years, influenced by various economic, political, and global factors. In the past decade, the rate has fluctuated between a high of 80.06 in 2020 and a low of 68.82 in 2017. The sharp depreciation of the INR against the USD in 2020 can be attributed to the economic slowdown caused by the COVID-19 pandemic, leading to a decline in foreign investments and a surge in demand for the US dollar.

Current Influencing Factors: A Complex Interplay of Variables

The USD to INR rate is influenced by several factors, including:

- Economic Growth: A strong Indian economy, characterized by high GDP growth rates, attracts foreign investments and leads to an appreciation of the INR.

- Interest Rate Differential: A higher interest rate in India compared to the US makes the INR a more attractive investment destination, leading to its appreciation.

- Inflation: High inflation in India erodes the value of the INR, leading to its depreciation.

- US Dollar Strength: A stronger US dollar against other global currencies can lead to a depreciation of the INR.

- Political Stability: Political uncertainty and instability in India can lead to a decline in foreign investments and a depreciation of the INR.

Future Projections: Navigating the Road Ahead

According to the International Monetary Fund (IMF), the USD to INR rate is projected to fluctuate between 85-90 in the next five years. However, this projection is subject to several assumptions and could change significantly based on unforeseen events or changes in economic conditions. Factors that could potentially lead to a further appreciation of the INR include:

- Sustained economic growth in India

- Higher interest rates in India

- Lower inflation

- A weakening US dollar

Implications for Businesses and Investors

The USD to INR rate has significant implications for businesses and investors. A weaker INR can make Indian exports more competitive, while a stronger INR can make imports more expensive. Investors need to monitor the exchange rate and factor it into their investment decisions. For example, a depreciation of the INR could lead to a higher return on investments denominated in US dollars.

How to Take Advantage of Fluctuations?

There are several strategies investors can employ to take advantage of fluctuations in the USD to INR rate:

- Hedging: Using financial instruments such as forward contracts or options to protect against exchange rate risk.

- Currency Arbitrage: Trading different currencies to profit from exchange rate fluctuations.

- Investing in Currency-Denominated Assets: Investing in assets denominated in different currencies to diversify investment portfolios.

Conclusion: A Dynamic and Interconnected Relationship

The USD to INR rate is a dynamic and interconnected relationship that influences international trade, investments, and global economic conditions. Understanding the factors that influence this rate and staying informed about its fluctuations is crucial for businesses, individuals, and investors to navigate the global financial landscape successfully.

Tables: Enhancing Understanding

| Date | USD to INR Rate |

|---|---|

| January 2020 | 70.52 |

| June 2020 | 80.06 |

| December 2020 | 73.25 |

| January 2021 | 73.31 |

| June 2021 | 75.01 |

Table 1: Historical USD to INR Exchange Rates

| Year | GDP Growth Rate (%) | Inflation Rate (%) |

|---|---|---|

| 2020 | -7.3 | 4.7 |

| 2021 | 8.7 | 5.4 |

| 2022 | 6.8 | 6.2 |

| 2023 | (Projected) 6.1 | 5.5 |

| 2024 | (Projected) 5.5 | 4.8 |

Table 2: Economic Indicators and Their Impact on USD to INR Rate

| Factor | Effect on USD to INR Rate |

|---|---|

| Economic Growth | Appreciation |

| Interest Rate Differential | Appreciation |

| Inflation | Depreciation |

| US Dollar Strength | Depreciation |

| Political Stability | Appreciation |

Table 3: Factors Influencing USD to INR Rate

| USD to INR Range | Scenario | Probability |

|---|---|---|

| 85-87 | Stable economic conditions | 60% |

| 88-90 | Strong economic growth | 30% |

| Over 90 | Weakening US dollar | 10% |

Table 4: Future Projections of USD to INR Rate