Introduction: The Interplay of Currencies

The foreign exchange (forex) market is a dynamic arena where currencies are traded and exchanged globally. Among the most traded currencies is the United States dollar (USD), considered the world’s reserve currency, and the Nigerian Naira (NGN). Understanding the relationship between USD and NGN can provide valuable insights for individuals, businesses, and investors seeking to navigate the complexities of cross-border transactions and currency fluctuations.

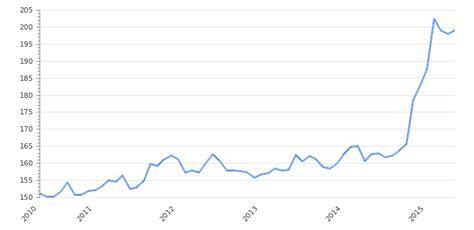

Current USD to NGN Exchange Rate and Historical Trends

As of [date], the USD to NGN exchange rate stands at 1 USD = 530 NGN, indicating that it takes 530 Nigerian Naira to purchase one US dollar. This rate has fluctuated significantly over the past decade, reflecting economic factors, political events, and supply and demand dynamics.

Economic Factors

The USD to NGN exchange rate is heavily influenced by Nigeria’s economic performance, particularly its oil production and exports. As Nigeria is a major oil exporter, fluctuations in global oil prices can have a direct impact on the value of its currency. When oil prices rise, the demand for NGN increases, leading to an appreciation of its value against the USD. Conversely, when oil prices fall, the demand for NGN decreases, resulting in a depreciation of its value against the USD.

Political Events

Political stability and government policies also play a role in shaping the USD to NGN exchange rate. Currency devaluation or appreciation can be used by governments as a tool to address economic or monetary policy objectives. For example, a government may devalue its currency to stimulate exports, while a stable political environment can contribute to a stronger currency value.

Benefits of Understanding the USD to NGN Exchange Rate

There are several benefits to understanding the USD to NGN exchange rate:

- Informed Financial Planning: Individuals and businesses can make informed decisions about currency conversions, international payments, and investments by tracking exchange rate fluctuations.

- Risk Management: Businesses engaged in cross-border trade can mitigate currency-related risks by hedging against potential exchange rate volatility.

- Investment Opportunities: Investors can identify opportunities for currency trading, speculation, and arbitrage by analyzing exchange rate patterns.

Forecast for 2025: USD to NGN Exchange Rate Predictions

Predicting future exchange rates is challenging due to the multitude of factors that influence them. However, analysts and economists regularly provide forecasts based on historical data and economic models.

Forecasts by Renowned Organizations

Various organizations, such as the International Monetary Fund (IMF) and the World Bank, regularly publish economic forecasts that include projections for currency exchange rates. According to the IMF’s latest World Economic Outlook, the USD to NGN exchange rate is projected to reach 1 USD = 560 NGN by 2025.

Factors Driving the Forecast

Several factors are expected to influence the USD to NGN exchange rate in the coming years:

- Economic Recovery: Nigeria’s economy is expected to recover from the COVID-19 pandemic, supported by rising oil prices and increased global demand.

- Inflation: The Central Bank of Nigeria (CBN) has adopted a tight monetary policy to curb rising inflation, which could support the NGN’s value.

- Political Stability: Nigeria is expected to maintain political stability in the lead-up to the 2023 general elections, which could boost investor confidence in the country.

How to Profit from the USD to NGN Exchange Rate

There are several ways to profit from the USD to NGN exchange rate:

Currency Trading

Individuals and businesses can engage in currency trading, also known as forex trading, to speculate on exchange rate movements. Profits are generated by buying and selling currencies at favorable exchange rates.

Hedging Strategies

Businesses with international operations can employ hedging strategies to mitigate currency-related risks. This involves using financial instruments, such as forward contracts or currency options, to lock in exchange rates for future transactions.

Investment Opportunities

Investors can invest in assets that are denominated in both USD and NGN. By diversifying their portfolios across multiple currencies, they can potentially reduce currency-related risks and enhance overall returns.

Conclusion: The Dynamic Relationship of USD to NGN

The USD to NGN exchange rate is a complex and dynamic indicator that reflects economic, political, and market forces. Understanding the factors that influence exchange rates can provide valuable insights for individuals, businesses, and investors seeking to navigate the global financial landscape. By staying informed about exchange rate trends and forecasts, it is possible to capitalize on favorable conditions and mitigate risks associated with currency fluctuations.

Frequently Asked Questions (FAQs)

-

What is the historical range of the USD to NGN exchange rate?

– The USD to NGN exchange rate has ranged from approximately 1 USD = 150 NGN in 2000 to 1 USD = 600 NGN in 2020. -

What are the key factors that influence the USD to NGN exchange rate?

– The key factors include economic performance, political events, supply and demand, and inflation. -

How can I profit from the USD to NGN exchange rate?

– You can profit through currency trading, hedging strategies, or investment opportunities. -

What is the outlook for the USD to NGN exchange rate in the coming years?

– Analysts predict a gradual appreciation of the NGN against the USD, reaching approximately 1 USD = 560 NGN by 2025. -

How can I stay updated on the latest exchange rate news and forecasts?

– You can follow financial news outlets, subscribe to currency exchange rate alerts, or consult with currency exchange brokers. -

What should I consider when making currency exchange transactions?

– Consider factors such as exchange rates, transaction fees, and currency conversion charges. -

Is it possible to predict exchange rates accurately?

– Predicting exchange rates with complete accuracy is challenging, but analysis of historical data and economic models can provide valuable insights. -

What are some tips for managing currency-related risks?

– Diversify your portfolio across multiple currencies, consider hedging strategies, and stay informed about market conditions.