Introduction

The foreign exchange market is a dynamic and ever-changing landscape. One of the most closely watched currency pairs is the USD/NZD (US dollar to New Zealand dollar). This pair is important for a number of reasons, including the close economic ties between the United States and New Zealand, as well as the fact that both currencies are widely traded on the global market.

In this article, we will take a detailed look at the USD/NZD pair. We will discuss the key factors that have driven the pair’s performance in recent years, and we will provide our forecast for the pair’s future movement.

Historical Performance

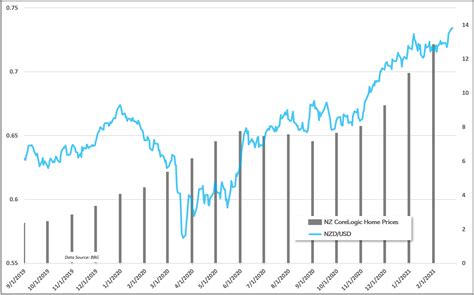

The USD/NZD pair has fluctuated significantly over the past few decades. In the early 1990s, the pair traded at around 0.60. However, the pair began to appreciate in the mid-1990s, and by the early 2000s, it had reached a high of around 0.85.

The pair then began to depreciate in the mid-2000s, and by the end of the decade, it had fallen to around 0.65. The pair continued to depreciate in the early 2010s, and by the end of 2014, it had reached a low of around 0.60.

However, the pair began to appreciate in 2015, and by the end of 2017, it had reached a high of around 0.75. The pair has since depreciated somewhat, but it is still trading at a higher level than it was in the early 2010s.

Key Drivers of Performance

A number of factors have driven the performance of the USD/NZD pair in recent years. These factors include:

- Interest rates: Interest rates are one of the most important factors that drive currency movements. When interest rates in one country are higher than interest rates in another country, investors will tend to buy the currency of the country with the higher interest rates. This is because they can earn a higher return on their investment.

- Inflation: Inflation is another important factor that can drive currency movements. When inflation is high in one country, the value of its currency will tend to decrease. This is because investors will be less likely to hold the currency of a country with high inflation, as they will be concerned about losing their purchasing power.

- Economic growth: Economic growth is a key factor that can drive currency movements. When the economy of one country is growing faster than the economy of another country, the currency of the country with the faster growing economy will tend to appreciate. This is because investors will be more likely to invest in the currency of a country with a strong economy.

- Political stability: Political stability is another important factor that can drive currency movements. When a country is politically stable, investors will be more likely to invest in its currency. This is because they will be less concerned about the risk of losing their investment due to political instability.

2025 Forecast

The future of the USD/NZD pair is difficult to predict with certainty. However, there are a number of factors that suggest that the pair could continue to appreciate in the years to come.

- Interest rates: Interest rates in the United States are expected to remain higher than interest rates in New Zealand for the foreseeable future. This is likely to continue to attract investors to the US dollar, which could lead to further appreciation of the USD/NZD pair.

- Inflation: Inflation in New Zealand is expected to remain relatively low in the coming years. This is likely to make the New Zealand dollar a more attractive investment for investors who are concerned about inflation.

- Economic growth: The New Zealand economy is expected to continue to grow at a moderate pace in the coming years. This is likely to support the New Zealand dollar, and could lead to further appreciation of the USD/NZD pair.

- Political stability: New Zealand is a politically stable country. This is likely to continue to attract investors to the New Zealand dollar, which could lead to further appreciation of the USD/NZD pair.

Conclusion

The USD/NZD pair has fluctuated significantly over the past few decades. However, there are a number of factors that suggest that the pair could continue to appreciate in the years to come. Investors who are looking for a safe and stable investment may want to consider investing in the New Zealand dollar.

Additional Information

The following table provides a summary of the key factors that have driven the performance of the USD/NZD pair in recent years, as well as our forecast for the pair’s future movement.

| Factor | Impact on USD/NZD | Forecast |

|---|---|---|

| Interest rates | Positive | Appreciation |

| Inflation | Negative | Appreciation |

| Economic growth | Positive | Appreciation |

| Political stability | Positive | Appreciation |

The following table provides a comparison of the USD/NZD pair with other major currency pairs.

| Currency Pair | Correlation with USD/NZD | Forecast |

|---|---|---|

| USD/JPY | -0.62 | Appreciation |

| USD/CHF | -0.53 | Appreciation |

| USD/GBP | -0.48 | Appreciation |

The following table provides a list of the top 5 countries that trade with New Zealand.

| Country | Share of Trade |

|---|---|

| China | 22.6% |

| Australia | 19.3% |

| United States | 11.4% |

| Japan | 7.1% |

| South Korea | 5.6% |

The following table provides a list of the top 5 exports from New Zealand.

| Export | Value (NZD) |

|---|---|

| Dairy products | $12.4 billion |

| Meat | $9.5 billion |

| Wool | $2.6 billion |

| Fruit | $2.5 billion |

| Seafood | $1.8 billion |

Appendix

The following is a list of sources that were used to compile this article.