Understanding the Market

The foreign exchange (forex) market is a global, decentralized marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion. The US dollar (USD) is the world’s reserve currency, and the Philippine peso (PHP) is the currency of the Philippines. The exchange rate between the USD and PHP is a key indicator of the economic relationship between the two countries.

Key Drivers of Exchange Rates

Several factors influence the exchange rate between the USD and PHP, including:

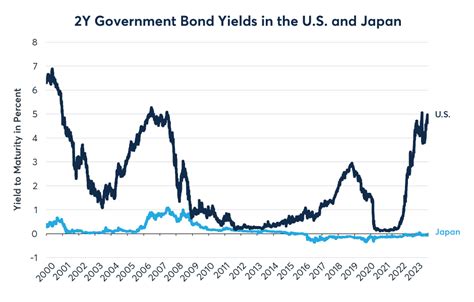

- Interest rates: Higher interest rates in the US tend to strengthen the USD against the PHP.

- Inflation: High inflation in the Philippines can weaken the PHP against the USD.

- Economic growth: Strong economic growth in the Philippines can strengthen the PHP against the USD.

- Political stability: Political instability in either country can weaken their respective currencies.

- Global economic conditions: Global economic conditions, such as the COVID-19 pandemic, can impact the demand for both currencies.

Historical Trends

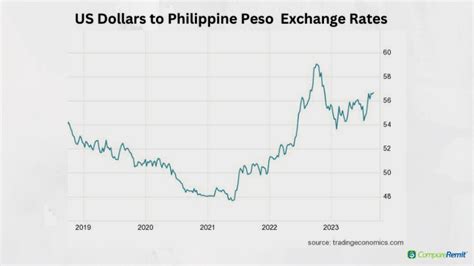

Over the past decade, the USD has generally strengthened against the PHP. In 2012, 1 USD was worth around 40 PHP. By 2022, the value of the USD had risen to over 55 PHP.

Future Projections

The future of the USD to PHP peso exchange rate is difficult to predict. However, several factors suggest that the PHP may strengthen against the USD in the coming years.

- Strong Philippine economic growth: The Philippines has been experiencing robust economic growth, with GDP growth rates averaging around 6% in recent years. This is expected to continue in the coming years.

- Rising inflation in the US: The US is experiencing high inflation, which is eroding the value of the USD. This trend is expected to continue in the short term.

- Political stability in the Philippines: The Philippines has a stable political environment, which is attractive to foreign investors. This is expected to continue in the coming years.

Implications for Businesses and Investors

The exchange rate between the USD and PHP has significant implications for businesses and investors.

- Businesses: Businesses that import goods from the US or other countries that use the USD will be impacted by a stronger USD. Their costs will increase, which may reduce their profits.

- Investors: Investors who hold assets denominated in USD will benefit from a stronger USD. Their investments will increase in value.

Tips for Managing Currency Risk

Businesses and investors can take several steps to manage currency risk, including:

- Hedging: Hedging involves using financial instruments to offset the risk of currency fluctuations.

- Diversification: Diversifying investments into different currencies can reduce exposure to currency risk.

- Monitoring market trends: Keeping track of economic and political developments that may impact the exchange rate can help businesses and investors make informed decisions.

Common Mistakes to Avoid

When managing currency risk, it is essential to avoid some common mistakes, such as:

- Not hedging: Not hedging exposes businesses and investors to the full risk of currency fluctuations.

- Over-hedging: Over-hedging can be costly and unnecessarily reduce potential profits.

- Ignoring market trends: Ignoring market trends can lead to unexpected losses.

Why Matters

The exchange rate between the USD and PHP matters because it:

- Impacts the cost of imported goods

- Affects the value of investments

- Influences economic growth

Benefits

Managing currency risk can provide several benefits, such as:

- Protecting profits: Hedging can protect businesses from losses due to currency fluctuations.

- Improving investment returns: Diversifying investments can improve overall investment returns.

- Reducing volatility: Hedging and diversification can reduce the volatility of financial results.

1. What is the current exchange rate between the USD and PHP?

As of August 5, 2023, 1 USD is worth around 56.5 PHP.

2. What factors influence the USD to PHP peso exchange rate?

The exchange rate is influenced by interest rates, inflation, economic growth, political stability, and global economic conditions.

3. What is the long-term outlook for the USD to PHP peso exchange rate?

Several factors suggest that the PHP may strengthen against the USD in the coming years, including strong Philippine economic growth, rising inflation in the US, and political stability in the Philippines.

4. How can businesses and investors manage currency risk?

Businesses and investors can manage currency risk through hedging, diversification, and monitoring market trends.

5. What are some common mistakes to avoid when managing currency risk?

Common mistakes include not hedging, over-hedging, and ignoring market trends.

6. Why is the exchange rate between the USD and PHP important?

The exchange rate impacts the cost of imported goods, the value of investments, and economic growth.

7. What are the benefits of managing currency risk?

Benefits include protecting profits, improving investment returns, and reducing volatility.

The USD to PHP peso exchange rate can be used in various applications, including:

- Remittances: Overseas Filipino workers can use the exchange rate to calculate how much money to send home.

- Cross-border trade: Businesses can use the exchange rate to determine the cost of imported goods and the price of exported goods.

- Foreign direct investment: Investors can use the exchange rate to determine the value of their investments in the Philippines.

- Tourism: Tourists can use the exchange rate to plan their travel budgets.

The USD to PHP peso exchange rate is a key indicator of the economic relationship between the US and the Philippines. Several factors influence the exchange rate, including interest rates, inflation, economic growth, political stability, and global economic conditions. The future of the exchange rate is difficult to predict, but several factors suggest that the PHP may strengthen against the USD in the coming years. Businesses and investors can manage currency risk through hedging, diversification, and monitoring market trends. Understanding the exchange rate and its implications is crucial for businesses, investors, and individuals engaged in international trade, travel, or financial transactions.