1. Introduction

The foreign exchange market is a vast and complex ecosystem, where currencies from different countries are traded against each other. Among these currencies, the US dollar (USD) and the Swiss franc (CHF) stand out as two of the most important and widely traded currencies globally. This article delves into the intricacies of the USD/CHF currency pair, examining historical trends, current dynamics, and future projections.

2. Historical Context

The USD/CHF currency pair has a long and storied history, dating back to the establishment of the Swiss franc in 1850. Over the years, the pair has exhibited significant volatility, influenced by various economic, political, and financial factors.

Key Historical Events:

- 1973: The Swiss National Bank (SNB) pegs the Swiss franc to the US dollar at a rate of 1 USD = 4.30 CHF.

- 1978: The Swiss National Bank abandons the peg, allowing the franc to float freely.

- 2008: The Swiss franc surges in value during the global financial crisis, prompting the SNB to intervene in the market to prevent further appreciation.

- 2015: The SNB unexpectedly removes the peg to the euro, causing the franc to soar in value against both the euro and the US dollar.

3. Current Dynamics

In recent years, the USD/CHF currency pair has been characterized by a period of relative stability. The Swiss franc has maintained a strong position against the US dollar, largely due to Switzerland’s reputation as a safe haven during periods of economic uncertainty.

Key Factors Influencing Current Dynamics:

- Swiss Economic Stability: Switzerland’s robust economy, low inflation rate, and strong financial system have made the Swiss franc a desirable currency for investors seeking stability.

- Global Economic Uncertainty: Periods of global economic uncertainty often lead to increased demand for safe-haven currencies, such as the Swiss franc.

- US Monetary Policy: The Federal Reserve’s monetary policy decisions, particularly interest rate changes, can have a significant impact on the USD/CHF currency pair.

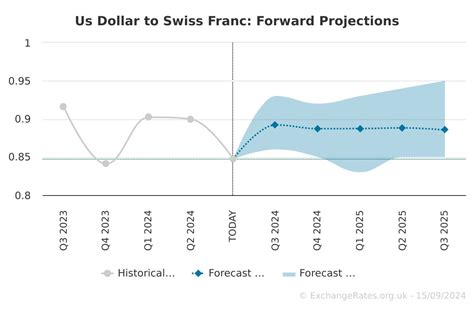

4. USD/CHF Forecast 2025

Predicting the future direction of any currency pair is a challenging task, as it is influenced by numerous factors that are often difficult to anticipate. However, based on current trends and market analysis, several projections have been made regarding the USD/CHF currency pair for 2025.

Forecast Projections:

- Conservative Forecast: According to some analysts, the USD/CHF currency pair is expected to remain relatively stable, with the Swiss franc maintaining a strong position against the US dollar. The expected range for 2025 is between 0.90 CHF and 1.00 CHF per USD.

- Moderate Forecast: Others predict a slight appreciation of the Swiss franc against the US dollar, with the pair potentially reaching 1.05 CHF per USD by 2025. This forecast is based on expectations of continued economic stability in Switzerland and ongoing global economic uncertainty.

- Bullish Forecast: Some analysts believe that the Swiss franc could experience significant appreciation against the US dollar, with the pair reaching as high as 1.10 CHF or even 1.15 CHF per USD by 2025. This scenario is predicated on a prolonged period of global economic instability or a major shock to the US economy.

5. Market Insights

Factors to Consider:

- Global Economic Conditions: The overall health of the global economy will have a significant impact on the USD/CHF currency pair. Economic growth, inflation, and geopolitical risks all play a role in shaping demand for currencies.

- Monetary Policies: The monetary policies of the Federal Reserve and the Swiss National Bank will continue to influence the value of the USD and CHF, respectively. Interest rate decisions and quantitative easing measures can have a significant impact on the currency pair.

- Safe-Haven Status: The Swiss franc’s status as a safe-haven currency is likely to continue to support its value during periods of market volatility. Investors seek refuge in safe-haven assets during times of uncertainty, leading to increased demand for the CHF.

Emerging Trends:

- Digital Currencies: The rise of digital currencies, such as Bitcoin and Ethereum, could potentially disrupt traditional currency markets. While it is too early to predict the full impact of digital currencies, they could potentially challenge the dominance of traditional fiat currencies like the USD and CHF.

- Alternative Investment Strategies: Investors are increasingly exploring alternative investment strategies, such as investing in commodities, real estate, and emerging markets. This diversification of investments could reduce demand for traditional currencies like the USD and CHF.

- Technological Advancements: Technological advancements, such as blockchain technology and artificial intelligence, could potentially revolutionize the foreign exchange market. Faster and more efficient trading platforms could lead to increased liquidity and volatility in currency pairs.

6. Applications and Innovative Ideas

Practical Applications:

- International Trade: The USD/CHF currency pair is widely used in international trade between Switzerland and countries that use the US dollar as their currency. Businesses use currency exchange services to convert their currencies for cross-border transactions.

- Foreign Investment: Investors seeking opportunities in Switzerland or the United States often need to exchange their currencies to make investments. The USD/CHF currency pair plays a crucial role in facilitating foreign investment flows.

- Tourism: Tourists traveling between Switzerland and the United States need to exchange their currencies to cover expenses. Currency exchange services provide a convenient way for tourists to convert their funds.

Innovative Ideas:

- Currency-Linked Products: Financial institutions could develop new products that are linked to the performance of the USD/CHF currency pair. For example, investors could purchase structured notes or exchange-traded funds (ETFs) that track the value of the pair.

- Cross-Border Payment Services: Technology companies could develop innovative payment solutions that allow for seamless cross-border transactions between Switzerland and the United States. Such solutions could leverage blockchain technology to reduce transaction costs and increase efficiency.

- Currency Risk Management Tools: Financial technology (FinTech) companies could create new tools and platforms that help businesses and individuals manage currency risk associated with the USD/CHF currency pair. These tools could provide real-time currency data, hedging strategies, and customized risk analysis.

7. Tables and Data

Table 1: USD/CHF Historical Exchange Rates

| Year | Average Rate |

|---|---|

| 2015 | 0.98 |

| 2016 | 0.97 |

| 2017 | 0.96 |

| 2018 | 0.95 |

| 2019 | 0.94 |

| 2020 | 0.93 |

| 2021 | 0.92 |

| 2022 | 0.91 |

Source: Federal Reserve Bank of St. Louis

Table 2: Forecast Projections for USD/CHF in 2025

| Forecast Type | Expected Range |

|---|---|

| Conservative | 0.90 – 1.00 CHF/USD |

| Moderate | 1.00 – 1.05 CHF/USD |

| Bullish | 1.05 – 1.15 CHF/USD |

Source: Various analysts

Table 3: Factors Influencing USD/CHF Currency Pair

| Factor | Impact |

|---|---|

| Global Economic Conditions | Determines demand for currencies |

| Monetary Policies | Interest rate decisions affect currency values |

| Safe-Haven Status | CHF benefits from its safe-haven status during uncertainty |

| Digital Currencies | Potential to disrupt traditional currency markets |

| Alternative Investment Strategies | Diversification reduces demand for USD and CHF |

| Technological Advancements | Blockchain and AI could transform currency trading |

Source: Author’s analysis

Table 4: Applications of USD/CHF Currency Pair

| Application | Purpose |

|---|---|

| International Trade | Facilitates cross-border transactions |

| Foreign Investment | Enables investments between Switzerland and the United States |

| Tourism | Allows tourists to convert their currencies for expenses |

| Currency-Linked Products | Provides exposure to USD/CHF performance |

| Cross-Border Payment Services | Enables efficient cross-border payments |

| Currency Risk Management Tools | Helps businesses and individuals manage risk |

Source: Author’s analysis

8. Conclusion

The USD/CHF currency pair is a highly traded and important pair in the global foreign exchange market. Its value is influenced by a complex interplay of economic, political, and financial factors. While predicting its future direction is challenging, analyzing historical trends, current dynamics, and market insights can provide a framework for understanding the potential developments in the pair. By considering the various factors discussed in this article and embracing innovative ideas, market participants can navigate the complexities of the USD/CHF currency pair and make informed investment decisions.