Introduction

The United States dollar (USD) and the Mexican peso (MXN) are two of the most widely traded currencies in the world. Their relationship is complex and constantly evolving, influenced by a multitude of economic, political, and social factors. This article provides a comprehensive analysis of the USD vs. peso exchange rate, exploring its historical trends, current dynamics, and potential future developments.

Historical Trends

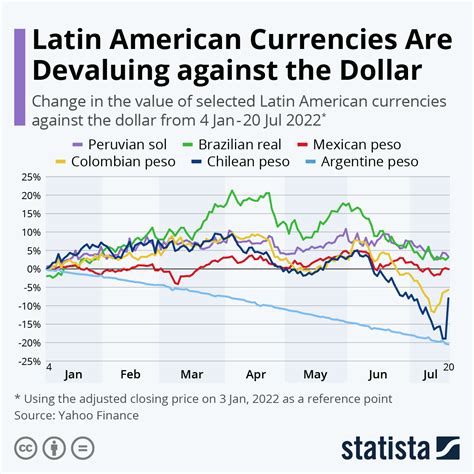

Historically, the USD has consistently maintained a stronger value than the peso. However, the relative strength of these currencies has fluctuated over time due to various factors.

- Economic Growth: The strength of the USD is often linked to the economic performance of the United States. Strong economic growth in the US tends to boost demand for the dollar, leading to its appreciation.

- Interest Rates: The interest rate differential between the US and Mexico also plays a role. Higher interest rates in the US make the dollar more attractive to investors, contributing to its appreciation.

- Political Stability: Political stability and economic uncertainty in Mexico can weaken the peso, while stability in the US can strengthen the dollar.

Current Dynamics

In recent years, the USD has continued to strengthen against the peso. This is largely due to the following factors:

- Strong US Economy: The US economy has been growing steadily, with low unemployment and a robust stock market, which has increased demand for the dollar.

- Fed Policy: The Federal Reserve’s decision to raise interest rates has made the dollar more appealing to investors, further contributing to its appreciation.

- Mexican Economic Challenges: Mexico has faced challenges such as political instability, high crime rates, and slowing economic growth, which have weakened the peso.

Future Outlook

The future direction of the USD vs. peso exchange rate is uncertain and depends on a range of factors.

- US Economic Performance: Continued strong economic growth in the US would likely support the dollar’s strength. However, a slowdown or recession could weaken it.

- Mexican Economic Reforms: Mexico’s government is implementing reforms to improve economic stability and growth. Successful implementation could strengthen the peso.

- Global Economic Conditions: The global economy can also impact the exchange rate, with strong global growth benefiting the dollar and weak growth benefiting the peso.

Implications

Fluctuations in the USD vs. peso exchange rate have significant implications for both countries.

- For the US: A stronger dollar can make US exports more expensive, potentially impacting businesses and trade.

- For Mexico: A weaker peso can make imports more expensive, leading to higher inflation and living costs.

Expert Perspectives

“The USD vs. peso exchange rate is influenced by a complex interplay of factors,” said Dr. Maria Sanchez, an economics professor at the University of Mexico. “While the US economy remains strong, Mexico faces challenges that could weaken the peso in the near term.”

“However, the Mexican government’s implementation of reforms could have a positive impact on the peso’s value over time,” added Dr. Sanchez.

Tips and Tricks for Navigating Currency Fluctuations

- Hedge Currency Risk: Businesses and individuals can use hedging tools to minimize the impact of currency fluctuations on their finances.

- Monitor Economic Data: Staying informed about economic indicators and news can help you anticipate currency movements.

- Diversify Investments: Distributing investments across different currencies and assets can reduce overall risk.

Case Study:

In 2020, the COVID-19 pandemic led to a sharp decline in tourism in Mexico, a major source of foreign currency. This weakened the peso against the USD, reaching an exchange rate of 25.2 pesos per dollar. However, Mexico’s gradual economic recovery in 2021 and 2022 has helped the peso strengthen, rising to around 20 pesos per dollar.

Conclusion

The USD vs. peso exchange rate is a dynamic and complex issue with significant implications for both countries. By understanding the historical trends, current dynamics, and potential future developments, businesses and individuals can navigate currency fluctuations effectively. As the global economic landscape continues to evolve, close monitoring and appropriate risk management strategies are crucial for mitigating the impact of currency changes.

Tables

Table 1: USD vs. Peso Exchange Rate Historical Data (2015-2022)

| Year | Exchange Rate (MXN/USD) |

|---|---|

| 2015 | 15.49 |

| 2016 | 18.77 |

| 2017 | 18.06 |

| 2018 | 19.19 |

| 2019 | 19.60 |

| 2020 | 25.20 |

| 2021 | 21.36 |

| 2022 | 20.11 |

Table 2: Factors Affecting USD vs. Peso Exchange Rate

| Factor | Impact |

|---|---|

| US Economic Growth | Strengthens Dollar |

| Mexican Economic Growth | Strengthens Peso |

| US Interest Rates | Strengthens Dollar |

| Mexican Interest Rates | Strengthens Peso |

| Political Stability | Strengthens Currency |

Table 3: Tips for Navigating Currency Fluctuations

| Tip | Description |

|---|---|

| Hedge Currency Risk | Use hedging tools to minimize losses |

| Monitor Economic Data | Stay informed about economic indicators |

| Diversify Investments | Spread investments across currencies and assets |

Table 4: Case Study: Peso Depreciation During COVID-19 Pandemic

| Period | Exchange Rate (MXN/USD) |

|---|---|

| Pre-Pandemic (2019) | 19.60 |

| During Pandemic (2020) | 25.20 |

| Post-Pandemic (2022) | 20.11 |