Understanding the Capital Gains Tax Rate

Capital gains tax is a tax levied on the profit made when an asset, such as a stock, bond, or real estate, is sold for a higher price than its purchase price. The capital gains tax rate varies depending on several factors, including the holding period of the asset and the taxpayer’s income.

Long-Term vs. Short-Term Capital Gains

The holding period of an asset determines whether it is classified as a long-term or short-term capital gain.

- Long-term capital gains: Assets held for more than one year

- Short-term capital gains: Assets held for one year or less

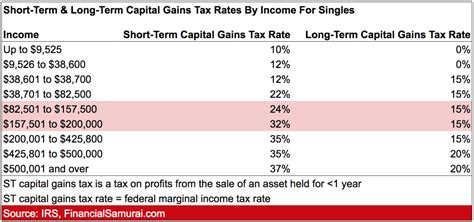

Tax Rates for Long-Term Capital Gains

Long-term capital gains are taxed at lower rates than short-term capital gains. The tax rates for long-term capital gains depend on the taxpayer’s income.

| Income Level | Tax Rate |

|---|---|

| 0% | $0 – $41,675 (single) / $0 – $83,350 (married filing jointly) |

| 15% | $41,675 – $459,750 (single) / $83,350 – $517,200 (married filing jointly) |

| 20% | Over $459,750 (single) / $517,200 (married filing jointly) |

Example: If you sell a stock that you held for two years for a profit of $10,000, and your taxable income is $60,000, you would pay capital gains tax at a rate of 15%. This means you would owe $1,500 in capital gains tax.

Tax Rates for Short-Term Capital Gains

Short-term capital gains are taxed at the same rates as ordinary income. The ordinary income tax rates for 2025 are as follows:

| Income Level | Tax Rate |

|---|---|

| 10% | $10,275 – $41,775 (single) / $20,550 – $83,550 (married filing jointly) |

| 12% | $41,775 – $89,075 (single) / $83,550 – $178,150 (married filing jointly) |

| 22% | $89,075 – $170,050 (single) / $178,150 – $340,100 (married filing jointly) |

| 24% | $170,050 – $215,950 (single) / $340,100 – $431,900 (married filing jointly) |

| 32% | $215,950 – $539,900 (single) / $431,900 – $647,850 (married filing jointly) |

| 35% | $539,900 – $1,077,350 (single) / $647,850 – $1,295,700 (married filing jointly) |

| 37% | Over $1,077,350 (single) / $1,295,700 (married filing jointly) |

Example: If you sell a stock that you held for six months for a profit of $5,000, and your taxable income is $45,000, you would pay capital gains tax at a rate of 22%. This means you would owe $1,100 in capital gains tax.

2025 Tax Changes

The Tax Cuts and Jobs Act of 2017 made significant changes to the capital gains tax rates. These changes are scheduled to expire in 2025, and it is unclear whether they will be extended. If the changes expire, the capital gains tax rates will revert to their pre-2017 levels, which were generally higher.

Tips and Tricks for Minimizing Capital Gains Taxes

There are several strategies you can use to minimize your capital gains taxes. These strategies include:

- Holding assets for more than one year: This will allow you to take advantage of the lower long-term capital gains tax rates.

- Tax-loss harvesting: Selling losing investments to offset gains from other investments.

- Using tax-advantaged accounts: Investing in tax-deferred accounts, such as IRAs and 401(k)s, can help you avoid paying capital gains tax on your investments.

- Gifting appreciated assets: Gifting appreciated assets to a charity or family member can help you avoid paying capital gains tax on the appreciation.

Common Mistakes to Avoid

There are also several common mistakes to avoid when it comes to capital gains taxes. These mistakes include:

- Not understanding the holding period: Make sure you are aware of the holding period for your investments to determine whether you will be subject to long-term or short-term capital gains tax rates.

- Not keeping track of your basis: Your basis is the amount you paid for an investment. You need to keep track of your basis to accurately calculate your capital gains.

- Selling investments at the wrong time: If you sell investments at the wrong time, you could end up paying more capital gains tax than necessary.

- Not considering the tax implications of gifting: Gifting appreciated assets can have tax implications. Make sure you understand the tax implications before gifting appreciated assets.

What You Can Do Now

If you are concerned about the impact of capital gains taxes on your investments, there are several things you can do now.

- Review your portfolio: Take a look at your portfolio and identify any investments that have appreciated in value. Consider holding these investments for more than one year to take advantage of the lower long-term capital gains tax rates.

- Consider tax-loss harvesting: If you have any losing investments, consider selling them to offset gains from other investments. This can help you reduce your overall capital gains tax liability.

- Use tax-advantaged accounts: If you are not already investing in tax-advantaged accounts, such as IRAs and 401(k)s, consider opening an account. This will allow you to avoid paying capital gains tax on your investments.

- Talk to a tax professional: If you have any questions about capital gains taxes, talk to a tax professional. They can help you understand the tax implications of your investments and develop a strategy to minimize your capital gains tax liability.

Conclusion

Capital gains taxes can have a significant impact on your investments. By understanding the capital gains tax rates, using tax-saving strategies, and avoiding common mistakes, you can minimize your capital gains tax liability and maximize your investment returns.