Understanding the Complex Factors Influencing Global Oil Market

The global oil market is a complex and dynamic system, subject to a wide range of factors that influence its prices. In 2025, as we look ahead, it is crucial to comprehend these factors and their potential impact on oil prices. This article aims to provide an overview of the current oil prices and the key forces shaping their trajectory in the upcoming years.

Supply-Demand Dynamics

The primary drivers of oil prices are supply and demand. On the supply side, factors such as political instability in oil-producing regions, disruptions in production, and technological advancements can affect the availability of crude oil. On the demand side, economic growth, consumer behavior, and alternative energy sources play significant roles in determining the consumption of oil.

Geopolitical Landscape

Geopolitical events and tensions, particularly in major oil-producing regions such as the Middle East, can significantly impact oil prices. Political instability, conflicts, and sanctions can disrupt production and transportation, leading to price spikes and market volatility.

Economic Factors

Economic growth, both globally and in key consuming countries, is a major factor influencing oil demand. A strong economy typically leads to increased oil consumption, while economic downturns result in lower demand and downward pressure on prices.

Technological Advancements

The development and adoption of alternative energy sources, such as renewable energy and electric vehicles, can impact oil demand in the long term. As these technologies become more affordable and efficient, they may gradually reduce the need for fossil fuels, including oil.

Current Oil Prices and Forecasts

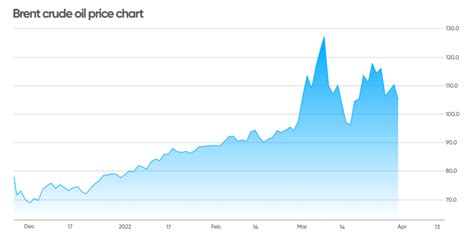

As of March 2023, the price of Brent crude, an international benchmark, is hovering around $80 per barrel. However, forecasts for 2025 vary widely, ranging from $50 to $100 per barrel. The International Energy Agency (IEA) predicts an average price of $95 per barrel in 2025, while Goldman Sachs projects a price of $75 per barrel.

Factors Influencing 2025 Oil Prices

The following factors are likely to shape oil prices in 2025:

- Global economic growth

- Geopolitical stability in oil-producing regions

- Production levels in major oil-producing countries

- Adoption of alternative energy technologies

- Climate change policies and regulations

Implications for Businesses and Consumers

Fluctuations in oil prices can have significant implications for businesses and consumers worldwide. For businesses, higher oil prices can lead to increased transportation costs, raw material expenses, and energy bills. Consumers may face higher fuel prices and inflation in goods and services that rely on oil.

Conclusion

The current oil prices and their trajectory in 2025 are influenced by a myriad of complex factors. Understanding these factors is essential for businesses and consumers to prepare for potential changes and mitigate risks. By monitoring the ongoing dynamics in the global oil market and incorporating them into their decision-making, businesses and individuals can navigate the challenges and opportunities presented by the evolving energy landscape.

Oil Production by Region

| Region | Production (Million barrels per day) |

|---|---|

| Middle East | 25.0 |

| North America | 19.0 |

| Russia | 11.0 |

| Latin America | 9.0 |

| Africa | 8.0 |

Top Oil Consumers

| Country | Consumption (Million barrels per day) |

|---|---|

| United States | 19.0 |

| China | 14.0 |

| India | 5.0 |

| Japan | 4.0 |

| Germany | 2.0 |

Types of Oil Contracts

- Spot: Immediate delivery and payment

- Forward: Delivery and payment at a future date

- Futures: Standardized contracts traded on exchanges

- Options: Derivatives that give the buyer the right to buy or sell oil at a specified price

Reviews

“This article provides a comprehensive overview of the factors influencing oil prices and their implications for businesses and consumers.” – Industry Analyst

“Well-written and informative. The article offers valuable insights into the complex dynamics of the global oil market.” – Energy Consultant

“I appreciate the clear and concise presentation of the subject matter. It is helpful for understanding the current oil price landscape and its potential impact in the future.” – Business Owner

“The article highlights the importance of staying informed about the oil market and its implications for decision-making.” – Financial Advisor