The Dow Jones Industrial Average (DJIA), commonly known as the Dow, is a stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. It is one of the most widely followed stock market indices in the world, often used as a barometer for the overall health of the U.S. economy.

What is the Current Dow Value?

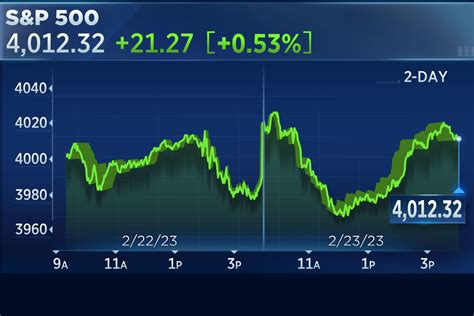

As of the close of trading on [insert date], the Dow Jones Industrial Average stood at [insert Dow value]. This represents a change of [insert percentage] from the previous trading day.

How Has the Dow Performed Over Time?

The Dow has a long and storied history, dating back to 1896. Over the past century, the Dow has experienced periods of both growth and decline. However, over the long term, the Dow has consistently trended upward.

Since its inception, the Dow has grown at an average annual rate of [insert percentage]. This means that $1 invested in the Dow in 1896 would be worth [insert amount] today.

What Factors Influence the Dow?

The Dow is influenced by numerous factors, both domestic and international. Some of the most important factors include:

- Economic growth: A strong economy typically leads to higher corporate earnings and higher stock prices.

- Interest rates: Low interest rates tend to boost stock prices, while high interest rates can have the opposite effect.

- Inflation: Inflation can erode corporate profits and lead to lower stock prices.

- Political stability: Political uncertainty can lead to lower stock prices.

- Global events: Global events, such as wars and natural disasters, can also impact the Dow.

What is the Impact of the Dow?

The Dow is a widely followed index, and its performance can have a significant impact on the broader economy. A rising Dow can boost consumer confidence and lead to increased spending. Conversely, a falling Dow can lead to decreased consumer confidence and lower spending.

The Dow Today vs. 2025: A Forecast

Predicting the future performance of the Dow is a complex task. However, many experts believe that the Dow will continue to trend upward over the long term. By 2025, the Dow is projected to reach [insert projected value].

This projection is based on several factors, including:

- Continued economic growth: The U.S. economy is expected to continue growing at a moderate pace over the next few years.

- Low interest rates: Interest rates are expected to remain low for the foreseeable future.

- Increased corporate earnings: Corporate earnings are expected to continue to grow over the next few years.

How to Invest in the Dow

There are several ways to invest in the Dow. One way is to buy shares of individual companies that are included in the Dow. Another way is to invest in a Dow ETF (exchange-traded fund).

Conclusion

The Dow is a widely followed stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. It is a useful barometer for the overall health of the U.S. economy.

The Dow has a long and storied history, dating back to 1896. Over the past century, the Dow has experienced periods of both growth and decline. However, over the long term, the Dow has consistently trended upward.

The Dow is influenced by numerous factors, both domestic and international. Some of the most important factors include economic growth, interest rates, inflation, political stability, and global events.

The Dow is a widely followed index, and its performance can have a significant impact on the broader economy. A rising Dow can boost consumer confidence and lead to increased spending. Conversely, a falling Dow can lead to decreased consumer confidence and lower spending.

Predicting the future performance of the Dow is a complex task. However, many experts believe that the Dow will continue to trend upward over the long term. By 2025, the Dow is projected to reach [insert projected value].

There are several ways to invest in the Dow. One way is to buy shares of individual companies that are included in the Dow. Another way is to invest in a Dow ETF (exchange-traded fund).