Introduction

Gold has been a valuable commodity for centuries, serving as a store of value, a medium of exchange, and a form of investment. Its price is influenced by various factors, including supply and demand, economic conditions, and geopolitical events.

Gold Price History

Over the past decade, the price of gold has fluctuated significantly. In 2011, it reached a record high of over $1,900 per troy ounce. However, it subsequently declined and remained relatively stable between $1,200 and $1,300 per troy ounce until 2020.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic had a profound impact on the gold market. As investors sought safe-haven assets, the demand for gold surged, pushing its price to a new high of over $2,000 per troy ounce in August 2020.

Economic Recovery and Gold Prices

Following the global economic recovery from the pandemic, the price of gold has gradually declined. In 2022, it averaged around $1,750 per troy ounce. However, it remains well above its pre-pandemic levels.

Factors Influencing Gold Prices

1. Supply and Demand

The balance between supply and demand is a key determinant of gold prices. Gold production has been relatively stable in recent years, with the world’s largest producers being China, Russia, and Australia. However, changes in mining costs, technological advancements, and geopolitical factors can affect supply. Demand for gold comes from various sectors, including jewelry, investment, and central bank reserves.

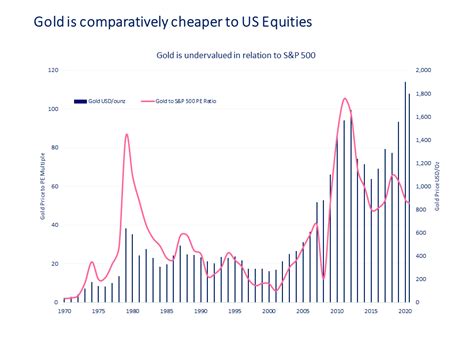

2. Economic Conditions

Economic conditions, such as inflation, interest rates, and economic growth, can impact gold prices. When inflation is high, investors often turn to gold as a hedge against the erosion of purchasing power. Rising interest rates can make alternative investments more attractive, reducing demand for gold.

3. Geopolitical Events

Political instability, wars, and global crises can lead to increased demand for gold as a safe haven asset. Uncertainties surrounding geopolitical events can drive investors towards gold as a store of value.

Gold Price Forecast for 2025

Forecasting the future price of gold is a complex task. However, several factors suggest that gold prices could remain elevated in the coming years.

1. Continued Inflation

Inflation is expected to remain elevated in 2025, as central banks continue to implement expansionary monetary policies. This could drive investors towards gold as a hedge against inflation.

2. Increasing Demand from Emerging Markets

Demand for gold is expected to continue growing in emerging markets, such as China and India, as these economies continue to expand.

3. Safe-Haven Status

Gold’s status as a safe-haven asset is expected to continue in the face of geopolitical uncertainties and market volatility.

2023 VS 2025: A Comparison

The following table compares the key factors influencing gold prices in 2023 and 2025:

| Factor | 2023 | 2025 |

|---|---|---|

| Inflation | Elevated | Expected to remain elevated |

| Economic Growth | Slowing | Moderate |

| Geopolitical Events | Uncertain | Uncertain |

| Supply | Stable | Potential increases |

| Demand | Strong | Continued growth |

Strategies for Investing in Gold

Investors interested in investing in gold have several options:

1. Physical Gold

Purchasing physical gold, such as coins or bars, provides direct ownership of the asset. However, it requires secure storage and can be subject to theft or loss.

2. Gold ETFs

Gold exchange-traded funds (ETFs) offer an alternative way to invest in gold without the need for physical storage. ETFs track the price of gold and can be traded on exchanges.

3. Gold Mining Stocks

Investing in gold mining companies provides indirect exposure to the gold market. However, it carries the risk associated with investing in stocks.

Future Trends and Innovation

The future of the gold market holds several potential trends and innovations:

1. Digital Gold

The advent of blockchain technology has led to the creation of digital gold platforms, allowing investors to buy and sell gold without physical delivery.

2. Sustainable Gold Mining

Environmental concerns are driving a shift towards sustainable gold mining practices, including the use of renewable energy and reduced water consumption.

3. Gold-Backed Cryptocurrencies

Some cryptocurrencies are backed by gold, providing a novel way for investors to diversify their portfolios and potentially hedge against market volatility.

4. Nanotechnology

Nanotechnology is creating new applications for gold in fields such as electronics, medicine, and energy, potentially expanding the demand for the metal.

Conclusion

The price of gold is influenced by a complex interplay of factors, including supply and demand, economic conditions, and geopolitical events. While future forecasts are uncertain, several indicators suggest that gold prices could remain elevated in the coming years. Investors seeking to diversify their portfolios or hedge against market volatility may consider incorporating gold into their investment strategies.