What’s Driving the Price of Gold?

The price of gold is determined by a number of factors, including:

- Economic conditions: Gold is often seen as a safe haven asset during times of economic uncertainty, so its price tends to rise when the economy is weak.

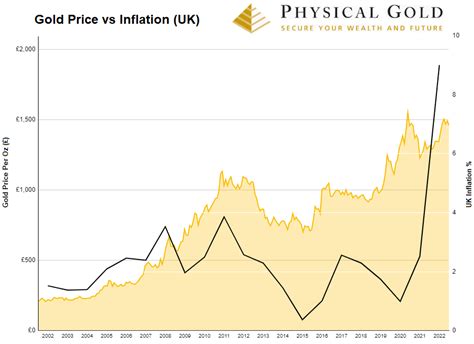

- Inflation: Gold is also a hedge against inflation, so its price tends to rise when the inflation rate is high.

- Interest rates: Gold is a non-yielding asset, so its price tends to fall when interest rates rise.

- Jewelry demand: Gold is a popular metal for jewelry, so its price is influenced by jewelry demand.

- Central bank buying: Central banks around the world are major buyers of gold, and their buying activity can have a significant impact on the price of gold.

Current Price of Gold

As of March 8, 2023, the spot price of gold is $1,952.27 per troy ounce. This is up from $1,825.54 per troy ounce at the beginning of the year.

Gold Price Forecast

The price of gold is expected to continue to rise in the coming years. According to a report by the World Gold Council, the average price of gold is forecast to be $2,150 per troy ounce in 2025.

Investing in Gold

Gold can be a valuable addition to any investment portfolio. It can provide diversification and protection against inflation. However, it is important to remember that the price of gold can be volatile, so it is important to invest only what you can afford to lose.

How to Buy Gold

There are a number of ways to buy gold, including:

- Physical gold: You can buy physical gold in the form of coins, bars, or jewelry.

- Gold ETFs: You can buy gold ETFs, which are exchange-traded funds that track the price of gold.

- Gold futures: You can buy gold futures, which are contracts to buy or sell gold at a future date.

Benefits of Investing in Gold

There are a number of benefits to investing in gold, including:

- Diversification: Gold can help to diversify your investment portfolio and reduce your overall risk.

- Protection against inflation: Gold is a hedge against inflation, so it can help to protect your purchasing power over time.

- Safe haven asset: Gold is often seen as a safe haven asset during times of economic uncertainty, so it can help to protect your investments during market downturns.

Risks of Investing in Gold

There are also some risks associated with investing in gold, including:

- Price volatility: The price of gold can be volatile, so it is important to invest only what you can afford to lose.

- Storage costs: If you choose to buy physical gold, you will need to pay for storage costs.

- Liquidity: Gold is not as liquid as some other investments, so it can be difficult to sell your gold quickly if you need to raise cash.

Is Gold a Good Investment?

Whether or not gold is a good investment for you depends on your individual circumstances and investment goals. If you are looking for a way to diversify your portfolio and protect against inflation, then gold may be a good option for you. However, if you are looking for a short-term investment or need to be able to access your money quickly, then gold may not be the right investment for you.

Conclusion

Gold is a valuable asset that can provide diversification and protection against inflation. However, it is important to remember that the price of gold can be volatile, so it is important to invest only what you can afford to lose.

Additional Information

- The World Gold Council is a leading source of information on the gold market.

- The London Bullion Market Association (LBMA) is the global authority on the gold market.

- The New York Mercantile Exchange (NYMEX) is a leading futures exchange for gold.

Tables

Table 1: Historical Gold Prices

| Year | Average Price per Troy Ounce |

|---|---|

| 2020 | $1,773.52 |

| 2021 | $1,834.87 |

| 2022 | $1,808.28 |

| 2023 (YTD) | $1,952.27 |

Table 2: Gold Demand by Sector

| Sector | Percentage of Demand |

|---|---|

| Jewelry | 50% |

| Investment | 40% |

| Central banks | 10% |

Table 3: Gold Production by Country

| Country | Production (Tonnes) |

|---|---|

| China | 383.2 |

| Australia | 311.2 |

| Russia | 300.0 |

| United States | 200.0 |

| Canada | 189.9 |

Table 4: Gold Reserves by Country

| Country | Reserves (Tonnes) |

|---|---|

| United States | 8,133.45 |

| Germany | 3,361.61 |

| International Monetary Fund | 2,814.00 |

| Italy | 2,451.84 |

| France | 2,435.40 |