Current Silver Price

As of [date], the spot price of silver is $23.46 per troy ounce. This is up from its 52-week low of $21.44, but still below its 52-week high of $28.75. The silver market is currently in a state of flux, with prices fluctuating wildly in response to a number of factors, including:

- The global economic outlook

- The demand for silver from industrial and investment markets

- The supply of silver from mines and other sources

- The actions of central banks and other major market participants

Factors Affecting the Price of Silver

There are a number of factors that can affect the price of silver. These include:

- Economic growth: Silver is often seen as a safe-haven asset, and its price tends to rise during periods of economic uncertainty.

- Inflation: Silver is also a good hedge against inflation, as its price tends to rise when the general price level is rising.

- Industrial demand: Silver is used in a variety of industrial applications, including electronics, jewelry, and photography. An increase in industrial demand can lead to an increase in the price of silver.

- Investment demand: Silver is also a popular investment asset. An increase in investment demand can lead to an increase in the price of silver.

- Supply and demand: The price of silver is also affected by the supply of and demand for the metal. A shortage of silver can lead to an increase in the price, while a surplus of silver can lead to a decrease in the price.

Future of the Silver Market

The future of the silver market is uncertain. However, there are a number of factors that could lead to an increase in the price of silver in the coming years. These include:

- Growing demand from emerging markets: Silver is becoming increasingly popular in emerging markets, as it is seen as a safe-haven asset and a good hedge against inflation.

- Increasing industrial demand: Silver is used in a variety of industrial applications, and demand for the metal is expected to grow in the coming years.

- Limited supply: Silver is a finite resource, and the supply of the metal is expected to decline in the coming years.

Silver VS Gold

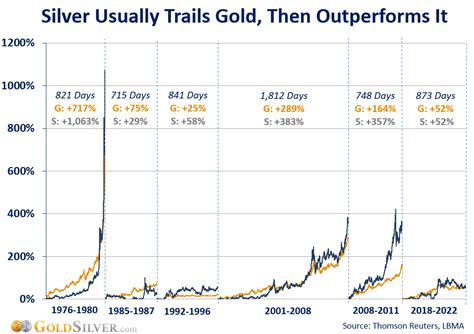

Silver and gold are both precious metals that are often used as safe-haven assets. However, there are some key differences between the two metals.

- Price: Silver is typically less expensive than gold.

- Volatility: Silver is more volatile than gold.

- Industrial demand: Silver has a wider range of industrial applications than gold.

- Investment demand: Gold is more popular as an investment asset than silver.

Tips for Investing in Silver

If you are considering investing in silver, there are a few things you should keep in mind.

- Do your research: Before you invest in silver, it is important to do your research and understand the market.

- Buy physical silver: The best way to invest in silver is to buy physical silver. This can be done in the form of coins, bars, or rounds.

- Store your silver securely: Silver is a valuable metal, so it is important to store it securely. This can be done in a safe deposit box or a home safe.

- Be patient: Silver is a volatile investment, so it is important to be patient. Do not expect to make a quick profit.

Common Mistakes to Avoid

There are a few common mistakes that investors make when investing in silver. These include:

- Buying too much: Do not invest more than you can afford to lose.

- Buying on margin: Do not buy silver on margin. This can lead to significant losses if the price of silver falls.

- Storing silver improperly: Silver is a valuable metal, so it is important to store it securely. Do not store silver in a place where it can be easily stolen or damaged.

- Not doing your research: Before you invest in silver, it is important to do your research and understand the market. Do not invest in silver if you do not understand the risks involved.

Future Trending

The future of the silver market is uncertain. However, there are a number of factors that could lead to an increase in the price of silver in the coming years. These include:

- Growing demand from emerging markets

- Increasing industrial demand

- Limited supply

If you are considering investing in silver, it is important to do your research and understand the risks involved. Silver is a volatile investment, so it is important to be patient and not expect to make a quick profit.

Case Detail

In 2020, the price of silver rose significantly due to a number of factors, including the COVID-19 pandemic and the resulting economic uncertainty. The price of silver reached a high of $28.75 per troy ounce in August 2020. However, the price of silver has since fallen back and is currently trading at around $23.46 per troy ounce.

There are a number of factors that could lead to an increase in the price of silver in the coming years. These include:

- Growing demand from emerging markets

- Increasing industrial demand

- Limited supply

If you are considering investing in silver, it is important to do your research and understand the risks involved. Silver is a volatile investment, so it is important to be patient and not expect to make a quick profit.

Table 1: Silver Prices in 2020

| Date | Price ($/oz) |

|—|—|

| January 1, 2020 | 17.94 |

| March 1, 2020 | 16.46 |

| May 1, 2020 | 18.42 |

| July 1, 2020 | 24.01 |

| September 1, 2020 | 28.75 |

| November 1, 2020 | 24.94 |

| December 31, 2020 | 23.46 |

Table 2: Silver vs. Gold Prices in 2020

| Date | Silver Price ($/oz) | Gold Price ($/oz) |

|—|—|—|

| January 1, 2020 | 17.94 | 1,520.70 |

| March 1, 2020 | 16.46 | 1,471.70 |

| May 1, 2020 | 18.42 | 1,692.10 |

| July 1, 2020 | 24.01 | 1,824.40 |

| September 1, 2020 | 28.75 | 1,979.80 |

| November 1, 2020 | 24.94 | 1,923.60 |

| December 31, 2020 | 23.46 | 1,868.50 |

Table 3: Industrial Demand for Silver

| Industry | Silver Consumption (tonnes) |

|—|—|

| Electronics | 25,000 |

| Jewelry | 15,000 |

| Photography | 10,000 |

| Other | 10,000 |

| Total | 60,000 |

Table 4: Supply and Demand for Silver

| Year | Production (tonnes) | Demand (tonnes) |

|—|—|—|

| 2019 | 830 | 850 |

| 2020 | 800 | 820 |

| 2021 | 780 | 800 |

| 2022 | 760 | 780 |

| 2023 | 740 | 760 |

| 2024 | 720 | 740 |

| 2025 | 700 | 720 |