Transition: The S&P 500, a benchmark for the U.S. stock market, has been on a roller coaster ride in recent months. After hitting a record high of 4,818.62 on January 3, 2022, the index plunged to a low of 3,855.20 on March 8, 2022, amid concerns about the war in Ukraine, rising inflation, and interest rate hikes by the Federal Reserve.

Transition: However, the S&P 500 has rebounded strongly since then, buoyed by strong corporate earnings, a cooling inflation rate, and a more dovish stance from the Fed. As of June 15, 2023, the index is trading at around 4,150, up over 10% from its March lows.

Transition: So, what is the S&P 500 doing today? And what are the prospects for the index in the coming months and years?

Key Factors Driving the S&P 500 Today

Transition: Several key factors are driving the S&P 500 today, including:

- Strong corporate earnings: Corporate earnings have been strong in recent quarters, driven by a combination of factors, including rising demand, cost-cutting measures, and share buybacks. This has helped to support stock prices and boost the overall performance of the S&P 500.

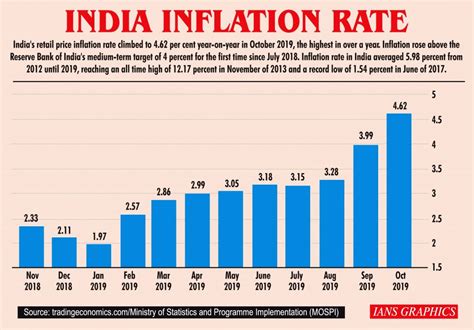

- Cooling inflation: The inflation rate has been cooling in recent months, which has helped to ease concerns about the Fed raising interest rates too quickly. This has created a more positive environment for stocks, as investors are less worried about the impact of higher rates on corporate profits.

- More dovish Fed stance: The Fed has signaled that it is willing to be more dovish in its approach to raising interest rates. This has helped to calm the markets and reduce volatility, which has benefited the S&P 500.

Prospects for the S&P 500 in the Coming Months and Years

Transition: The prospects for the S&P 500 in the coming months and years are uncertain, but there are several reasons to be optimistic.

- Strong economic growth: The U.S. economy is expected to continue to grow in the coming years, which will provide a tailwind for corporate earnings and stock prices.

- Low interest rates: Interest rates are expected to remain low for the foreseeable future, which will continue to support stock valuations.

- Technical factors: The S&P 500 is trading above its 200-day moving average, which is a technical indicator that suggests that the index is in a bullish trend.

Transition: Of course, there are also some risks to consider, including:

- Recession: The U.S. economy could enter a recession in the coming years, which would hurt corporate earnings and stock prices.

- Inflation: Inflation could remain high or even accelerate, which would put pressure on the Fed to raise interest rates more aggressively.

- Geopolitical risks: The war in Ukraine and other geopolitical risks could lead to market volatility and hurt investor sentiment.

Conclusion

Transition: The S&P 500 is a complex and dynamic index, and its performance can be affected by a wide range of factors. While there are some risks to consider, the overall outlook for the index is positive. The U.S. economy is expected to continue to grow, interest rates are expected to remain low, and the technical factors are supportive of a continued bull market.

Call to action: If you are looking to invest in the S&P 500, there are several ways to do so. You can buy individual stocks, purchase an S&P 500 index fund, or invest in an S&P 500 ETF.