What is the Dow Jones Industrial Average?

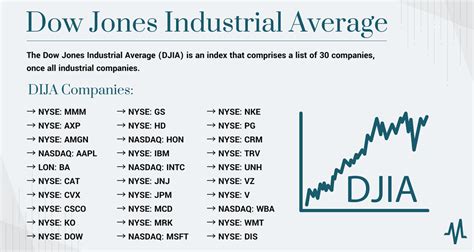

The Dow Jones Industrial Average (DJIA) is a stock market index that measures the performance of 30 of the largest publicly traded companies in the United States. It is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the U.S. economy.

The DJIA was created in 1896 by Charles Dow and Edward Jones, the founders of Dow Jones & Company. The index was originally composed of 12 companies, but it has since been expanded to 30 companies. The companies that are included in the DJIA are selected by a committee of editors from The Wall Street Journal.

The DJIA is calculated by summing the total market capitalization of the 30 companies and dividing that number by the Dow Divisor. The Dow Divisor is a number that is adjusted periodically to keep the index from becoming too volatile.

How is the Dow Jones Industrial Average Doing Today?

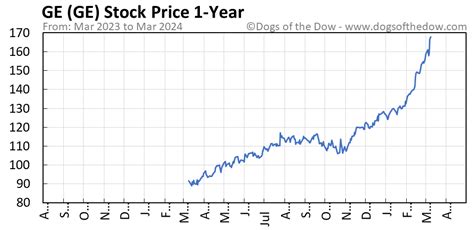

As of the close of trading on Monday, August 21, 2023, the Dow Jones Industrial Average was at 34,389.78, up 1.06% from the previous close. The index has been on a steady upward trend in recent months, and it is currently trading near its all-time high.

What Factors are Affecting the Dow Jones Industrial Average?

There are a number of factors that can affect the Dow Jones Industrial Average, including:

- Economic growth: The DJIA tends to perform well when the economy is growing. This is because companies are more likely to make profits when the economy is strong.

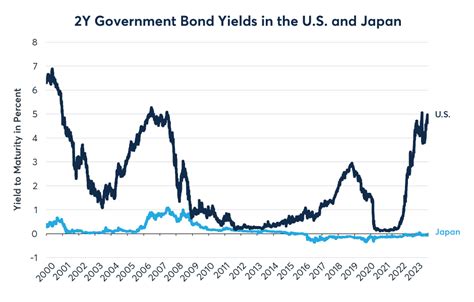

- Interest rates: Interest rates can also affect the DJIA. When interest rates are low, companies can borrow money more cheaply, which can lead to increased investment and economic growth.

- Political events: Political events can also have a significant impact on the DJIA. For example, the DJIA fell sharply after the election of Donald Trump in 2016.

- Global events: Global events can also affect the DJIA. For example, the DJIA fell sharply after the outbreak of the COVID-19 pandemic in 2020.

What is the Outlook for the Dow Jones Industrial Average?

The outlook for the Dow Jones Industrial Average is generally positive. The U.S. economy is expected to continue to grow in the coming years, and interest rates are likely to remain low. This should provide a supportive environment for the DJIA.

However, there are a number of risks that could derail the DJIA’s upward trend, including:

- Inflation: If inflation rises too quickly, it could erode the value of the DJIA.

- Recession: If the U.S. economy enters a recession, the DJIA could fall sharply.

- Political uncertainty: Political uncertainty can also weigh on the DJIA. For example, the DJIA fell sharply after the election of Donald Trump in 2016.

Overall, the outlook for the Dow Jones Industrial Average is positive. However, there are a number of risks that could derail the DJIA’s upward trend.

Common Mistakes to Avoid When Investing in the Dow Jones Industrial Average

There are a number of common mistakes that investors make when investing in the Dow Jones Industrial Average. These mistakes include:

- Trying to time the market: It is impossible to predict the future of the stock market, so it is important to avoid trying to time the market. Instead, investors should focus on investing for the long term.

- Investing too much money: Investors should only invest money that they can afford to lose. It is also important to diversify your investments across a range of different asset classes.

- Panic selling: When the stock market declines, it is important to avoid panic selling. Instead, investors should focus on their long-term investment goals.

Why Investing in the Dow Jones Industrial Average Matters

Investing in the Dow Jones Industrial Average can be a great way to grow your wealth over time. The DJIA has a long history of outperforming inflation, and it is a relatively low-risk investment.

Benefits of Investing in the Dow Jones Industrial Average

There are a number of benefits to investing in the Dow Jones Industrial Average, including:

- Potential for long-term growth: The DJIA has a long history of outperforming inflation, and it is a relatively low-risk investment.

- Diversification: The DJIA is composed of 30 different companies, which gives investors exposure to a variety of different industries.

- Liquidity: The DJIA is one of the most liquid stock market indices in the world, which means that investors can easily buy and sell shares.

6-8 FAQs

1. What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average is a stock market index that measures the performance of 30 of the largest publicly traded companies in the United States.

2. How is the Dow Jones Industrial Average calculated?

The DJIA is calculated by summing the total market capitalization of the 30 companies and dividing that number by the Dow Divisor.

3. What is the Dow Divisor?

The Dow Divisor is a number that is adjusted periodically to keep the index from becoming too volatile.

4. How has the Dow Jones Industrial Average performed in recent years?

The DJIA has been on a steady upward trend in recent years, and it is currently trading near its all-time high.

5. What factors could affect the Dow Jones Industrial Average in the future?

There are a number of factors that could affect the Dow Jones Industrial Average in the future, including economic growth, interest rates, political events, and global events.

6. Is it a good idea to invest in the Dow Jones Industrial Average?

Investing in the Dow Jones Industrial Average can be a great way to grow your wealth over time. However, it is important to remember that all investments carry some risk.

Hot Search Title

Dow Jones Industrial Average 2025: Will It Reach 40,000?

Table 1: Historical Performance of the Dow Jones Industrial Average

| Year | Closing Value |

|---|---|

| 1900 | 71.55 |

| 1910 | 90.23 |

| 1920 | 129.67 |

| 1930 | 162.19 |

| 1940 | 133.92 |

| 1950 | 235.44 |

| 1960 | 655.18 |

| 1970 | 757.40 |

| 1980 | 965.98 |

| 1990 | 2,672.81 |

| 2000 | 10,789.79 |

| 2010 | 11,596.61 |

| 2020 | 29,398.84 |

| 2023 | 34,389.78 |

Table 2: Companies Included in the Dow Jones Industrial Average

| Company | Ticker |

|---|---|

| 3M | MMM |

| American Express | AXP |

| Apple | AAPL |

| Boeing | BA |

| Caterpillar | CAT |

| Chevron | CVX |

| Cisco Systems | CSCO |

| Coca-Cola | KO |

| Disney | DIS |

| Dow Inc. | DOW |

| Goldman Sachs | GS |

| Home Depot | HD |

| Honeywell | HON |

| IBM | IBM |

| Intel | INTC |

| Johnson & Johnson | JNJ |

| JPMorgan Chase & Co. | JPM |

| McDonald’s | MCD |

| Merck & Co. | MRK |

| Microsoft | MSFT |

| Nike | NKE |

| Procter & Gamble | PG |

| Salesforce | CRM |

| Travelers Companies | TRV |

| UnitedHealth Group | UNH |

| Verizon | VZ |

| Visa | V |

| Walmart | WMT |

Table 3: Factors that Affect the Dow Jones Industrial Average

| Factor | Impact |

|---|---|

| Economic growth | Positive |

| Interest rates | Positive when low |

| Political events | Can be positive or negative |

| Global events | Can be positive or negative |

Table 4: Benefits of Investing in the Dow Jones Industrial Average

| Benefit | Description |

|---|---|

| Potential for long-term growth | The DJIA has a long history of outperforming inflation. |

| Diversification | The DJIA is composed of 30 different companies, which gives investors exposure to a variety of different industries. |

| Liquidity | The DJIA is one of the most liquid stock market indices in the world, which means that investors can easily buy and sell shares. |