Earnings Call Dates and Times

Nvidia Corporation typically holds its quarterly earnings calls approximately one month after the end of each fiscal quarter. The company follows a January-April-July-October fiscal year. Based on this schedule, the expected earnings call dates for 2025 are as follows:

| Quarter | Earnings Date |

|---|---|

| Q1 2025 | Thursday, February 13, 2025 |

| Q2 2025 | Thursday, May 15, 2025 |

| Q3 2025 | Thursday, August 14, 2025 |

| Q4 2025 | Thursday, November 13, 2025 |

Please note that these dates are subject to change, and Nvidia will announce the official dates and details closer to each quarter end.

How to Access the Earnings Call

Investors and analysts can access Nvidia’s earnings calls via the company’s Investor Relations website: https://investor.nvidia.com/events-and-presentations

Live webcasts of the calls are available, and a recording of the call and the accompanying presentation materials are typically posted on the website within a few hours after the call ends.

What to Expect from the Earnings Call

Nvidia’s earnings calls provide valuable insights into the company’s financial performance, strategic initiatives, and market outlook. Key topics that investors may want to pay attention to during the calls include:

- Revenue and earnings per share results

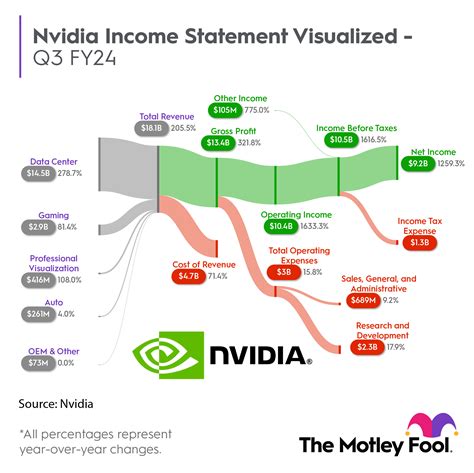

- Segment performance (gaming, data center, professional visualization)

- Gross and operating margins

- Research and development expenses

- Market share and competitive landscape

- Growth drivers and future outlook

Analysts and investors often use the earnings calls to ask questions and clarify management’s comments. Transcripts of the calls are typically available on the company’s website within a few days after the call.

Historical Earnings Performance

In recent quarters, Nvidia has consistently exceeded analysts’ expectations and reported strong financial results. For example, in its Q4 2022 earnings call, the company reported revenue of $6.05 billion, a 21% increase year-over-year, and earnings per share of $0.88, a 31% increase year-over-year.

Nvidia’s growth has been driven by the increasing demand for its graphics processing units (GPUs) in various applications, including gaming, data center computing, and artificial intelligence. The company is also benefiting from its strong brand reputation and its leadership position in the GPU market.

Market Insights

Nvidia’s earnings calls provide valuable insights into the overall technology industry and the key trends shaping the market. In recent calls, management has highlighted the following market trends:

- The continued growth of the gaming industry, driven by the popularity of esports and the increasing accessibility of gaming platforms

- The increasing adoption of artificial intelligence (AI) and machine learning (ML) in various industries, which is driving demand for high-performance computing solutions

- The growing importance of cloud computing and the need for data center infrastructure to support the increasing volume of data being generated and processed

Nvidia is well-positioned to capitalize on these market trends with its strong product portfolio and its commitment to innovation. The company’s earnings calls provide investors with an opportunity to gain insights into these trends and assess Nvidia’s competitive advantages.

Common Mistakes to Avoid

Investors should be aware of the following common mistakes to avoid when evaluating Nvidia’s earnings calls:

- Focusing solely on revenue growth: While revenue growth is an important metric, it is also important to consider other factors, such as profitability, margins, and expenses.

- Overreacting to short-term fluctuations: Nvidia’s stock price can be volatile, and investors should not make investment decisions based on short-term fluctuations in earnings or revenue.

- Ignoring the competitive landscape: Nvidia operates in a competitive industry, and investors should be aware of the competitive dynamics and the potential impact of competitors on the company’s performance.

Conclusion

Nvidia’s earnings calls are a valuable source of information for investors and analysts. The calls provide insights into the company’s financial performance, strategic initiatives, and market outlook. Investors should carefully consider the information presented during the calls and use it to inform their investment decisions.