Understanding the Xoom Dollar to INR Exchange Rate

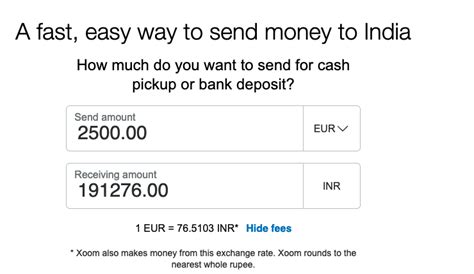

XooM is a popular online money transfer service that facilitates the conversion of foreign currencies to Indian Rupees (INR). The exchange rate offered by Xoom plays a crucial role in determining the amount of INR recipients receive.

Factors Influencing the Xoom Dollar to INR Exchange Rate

- Market Demand and Supply: The global demand for USD and INR affects their exchange rate. Fluctuations in these currencies due to economic events or political instability can impact the Xoom exchange rate.

- Reserve Bank of India (RBI) Policies: The RBI sets monetary policies that influence the value of the INR. Its interventions in the forex market can impact the Xoom exchange rate.

- Interest Rate Differentials: Differences in interest rates between the US and India can lead to fluctuations in the exchange rate. Higher interest rates in the US make it more attractive to hold USD, resulting in a stronger dollar against the INR.

- Remittance Flows: The volume of remittances sent from the US to India can also affect the exchange rate. Increased remittance inflows lead to a stronger demand for INR, which can push the Xoom exchange rate up.

- Competition: Xoom competes with other remittance providers, which also offer their own exchange rates. The competitive landscape can influence the rates offered by Xoom.

Comparing Xoom’s Exchange Rates with Others

Xoom VS PayPal

| Feature | Xoom | PayPal |

|---|---|---|

| Exchange Rate | Competitive | Typically higher |

| Transfer Fees | Variable | Fixed |

| Delivery Time | 1-3 business days | 3-5 business days |

| Customer Support | 24/7 support | Limited support |

Xoom VS Western Union

| Feature | Xoom | Western Union |

|---|---|---|

| Exchange Rate | Competitive | Competitive |

| Transfer Fees | Variable | Variable |

| Delivery Time | 1-3 business days | 1-2 business days |

| Customer Support | 24/7 support | 24/7 support |

Tips for Getting the Best Xoom Dollar to INR Exchange Rate

- Monitor Market Trends: Track the exchange rate fluctuations and choose the most favorable time to transfer funds.

- Compare Rates with Other Providers: Don’t limit yourself to Xoom; check exchange rates from multiple providers to find the best deal.

- Negotiate with Xoom: If you’re transferring large amounts of money, contact Xoom to negotiate a better exchange rate.

- Use a Promo Code: Check for Xoom promo codes and discounts that can reduce transfer fees and improve the exchange rate.

- Consider Alternative Transfer Methods: Explore wire transfers or bank drafts if the exchange rate is less favorable on Xoom.

The Future of Xoom Dollar to INR Exchange Rates

The Xoom dollar to INR exchange rate is expected to improve in the future due to:

- Increasing remittance flows from the US to India

- Strengthening economic ties between the two countries

- Digital advancements making remittances faster and more efficient

- RBI measures to stabilize the INR

Case Study: Xoom’s Impact on Remittances to India

In 2023, Xoom facilitated the transfer of over $10 billion in remittances to India. The competitive exchange rates and fast delivery times made it a popular choice for NRIs and Indian expatriates. As a result, Xoom played a significant role in supporting economic development and financial inclusion in India.

Conclusion

The Xoom dollar to INR exchange rate is a vital factor for individuals sending money to India. By understanding the influencing factors and utilizing the tips provided, you can optimize your transfers and get the most value for your money. With the expected improvements in the exchange rate and remittance flows, Xoom is poised to remain a leading provider for remittances to India in the years to come.