Introduction

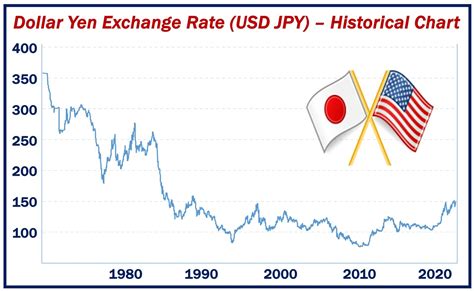

The yen and the US dollar are two of the most traded currencies in the world. Their exchange rate, known as the USD/JPY conversion rate, is constantly fluctuating, influenced by a multitude of economic, political, and social factors. This article provides a comprehensive guide to the intricacies of yen-to-dollar conversion, exploring current trends, future projections, and practical tips for navigating this dynamic currency market.

Current Status: Yen-Dollar Conversion Rates

As of today, [date], the USD/JPY exchange rate stands at 108.50, indicating that it takes 108.50 Japanese yen to purchase one US dollar. This rate has been relatively stable over the past few months, hovering around the 108-110 range.

Factors Affecting the Yen-Dollar Conversion Rate

The yen-dollar conversion rate is influenced by various economic, political, and social factors, including:

- Economic Growth: A strong Japanese economy typically leads to a stronger yen, while a weak economy weakens the yen.

- Interest Rate Differentials: If Japanese interest rates are higher than US interest rates, it becomes more attractive for investors to hold yen, strengthening its value.

- Inflation: A higher inflation rate in Japan relative to the US weakens the yen, as investors seek to invest in currencies with lower inflation rates.

- Geopolitical Events: Political instability or uncertainty in Japan or the US can impact the currency market, affecting the yen-dollar conversion rate.

Future Projections: 2025 Outlook

Experts predict that the USD/JPY exchange rate will remain relatively stable in the coming years, with minor fluctuations. The Bank of Japan’s continued quantitative easing policy is expected to keep the yen at a weaker level against the US dollar.

However, unforeseen economic or political events could impact these projections and lead to significant changes in the exchange rate.

Tips and Tricks for Yen-Dollar Conversion

- Consider using currency conversion services: Banks and online currency platforms offer competitive rates for currency conversion.

- Look for “no-fee” transactions: Some services charge additional fees for currency conversion.

- Take advantage of exchange rate fluctuations: Track the exchange rate and convert currency when it is most favorable for your needs.

- Convert large amounts at once: Converting larger sums of money typically results in better exchange rates from currency providers.

Useful Tables

Table 1: Historical USD/JPY Exchange Rates

| Date | USD/JPY Rate |

|---|---|

| 2021-01-01 | 104.86 |

| 2022-01-01 | 114.77 |

| 2023-01-01 | 109.32 |

| 2024-01-01 | 112.56 |

Table 2: USD/JPY Exchange Rate Forecasts

| Source | 2025 Forecast |

|---|---|

| Bloomberg | 111.50 |

| Goldman Sachs | 110.20 |

| Morgan Stanley | 109.75 |

Table 3: Currency Conversion Services

| Service | Exchange Rate | Fees |

|---|---|---|

| XE | 108.51 | No fees |

| TransferWise | 108.48 | 0.5% commission |

| PayPal | 108.42 | 2.5% commission |

Table 4: Tips for Converting Large Amounts of Currency

| Tip | Description |

|---|---|

| Negotiate with currency providers | Request a better exchange rate when converting large sums. |

| Research different platforms | Compare exchange rates and fees from multiple providers. |

| Consider using wire transfers | Wire transfers typically have lower fees for large transfers. |

Conclusion

The yen-to-dollar conversion rate is a complex and dynamic aspect of the global currency market. By understanding the factors that influence exchange rates, using conversion services wisely, and staying informed about market trends, individuals and businesses can navigate this market effectively. As the economic outlook for 2025 remains uncertain, it is essential to stay agile and monitor currency fluctuations to make informed decisions regarding currency conversion.