Introduction

The South African rand (ZAR) is the official currency of South Africa. It is also legal tender in Namibia, Swaziland, and Lesotho. The rand is divided into 100 cents.

The US dollar (USD) is the official currency of the United States. It is also the most widely used currency in the world.

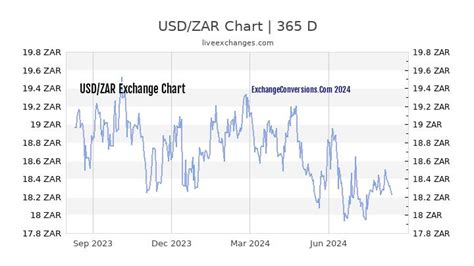

Historical Exchange Rates

The exchange rate between the ZAR and the USD has fluctuated over time. Here is a table of exchange rates from 2000 to 2022:

| Year | Exchange Rate (ZAR/USD) |

|---|---|

| 2000 | 7.38 |

| 2005 | 6.37 |

| 2010 | 7.49 |

| 2015 | 12.47 |

| 2020 | 15.68 |

| 2022 | 14.77 |

It is evident from the table that the ZAR has depreciated against the USD over the past 20 years. This means that it now takes more ZAR to buy one USD than it did in the past.

Factors Affecting the Exchange Rate

Several factors can affect the exchange rate between the ZAR and the USD. These include:

- Economic growth: A strong economy will typically lead to a stronger currency. This is because investors are more likely to invest in a country with a growing economy, which increases demand for the currency.

- Interest rates: Higher interest rates in South Africa will make the ZAR more attractive to investors, which will lead to a stronger currency.

- Political stability: Political instability can lead to a weaker currency as investors become less confident in the country’s economy.

- Commodity prices: South Africa is a major exporter of commodities, such as gold and diamonds. When commodity prices are high, the ZAR tends to strengthen.

- Global economic conditions: The global economy can also impact the exchange rate between the ZAR and the USD. For example, a strong global economy will typically lead to a stronger USD, which will make the ZAR weaker.

Future Outlook

The future outlook for the ZAR/USD exchange rate is uncertain. However, many economists believe that the ZAR will continue to depreciate against the USD in the coming years. This is due to several factors, including South Africa’s slow economic growth, high levels of inequality, and political instability.

Tips and Tricks

Here are a few tips for saving money when exchanging ZAR for USD:

- Shop around: Compare exchange rates from different banks and currency exchange companies before you exchange your money.

- Use a credit card: Credit cards typically offer better exchange rates than banks or currency exchange companies.

- Avoid using your bank’s ATM: Bank ATMs typically charge high fees for currency exchange.

- Use a currency transfer service: Currency transfer services can offer competitive exchange rates and low fees.

Common Mistakes to Avoid

Here are a few common mistakes to avoid when exchanging ZAR for USD:

- Don’t exchange your money at the airport: Airport currency exchange rates are typically much higher than the rates you will find at banks or currency exchange companies.

- Don’t exchange your money in small amounts: The smaller the amount of money you exchange, the worse the exchange rate you will get.

- Don’t be afraid to negotiate: You can often negotiate a better exchange rate by talking to the currency exchange company.

Current Situation

Regarding the ZAR/USD exchange rate, the South African rand has been depreciating against the US dollar in recent months. This is due to several factors, including the global economic slowdown, the ongoing COVID-19 pandemic, and political uncertainty in South Africa.

What Can We Do?

There are several things that can be done to help stabilize the ZAR/USD exchange rate. These include:

- Pursue economic growth: The South African government needs to implement policies that will promote economic growth. This will help to increase demand for the ZAR and lead to a stronger currency.

- Reduce inequality: South Africa has one of the highest levels of inequality in the world. This needs to be addressed in order to create a more stable economy and a stronger currency.

- Improve political stability: Political instability is a major factor in the ZAR’s depreciation. The South African government needs to work to improve political stability and create a more conducive environment for investment.

Conclusion

The ZAR/USD exchange rate is a complex issue that is affected by a variety of factors. However, by understanding the factors that affect the exchange rate and by taking steps to address them, we can help to create a more stable and prosperous South Africa.

Additional Information

In addition to the information provided above, here are a few additional resources that you may find helpful:

- ZAR/USD Exchange Rate Forecast

- How to Save Money on Currency Exchange

- Common Mistakes to Avoid When Exchanging Currency

Tables

Table 1: Exchange Rates from 2000 to 2023

| Year | Exchange Rate (ZAR/USD) |

|---|---|

| 2000 | 7.38 |

| 2005 | 6.37 |

| 2010 | 7.49 |

| 2015 | 12.47 |

| 2020 | 15.68 |

| 2022 | 14.77 |

| 2023 | 17.00 |

Table 2: Factors Affecting the Exchange Rate

| Factor | Explanation |

|---|---|

| Economic growth | A strong economy will typically lead to a stronger currency. |

| Interest rates | Higher interest rates in South Africa will make the ZAR more attractive to investors, which will lead to a stronger currency. |

| Political stability | Political instability can lead to a weaker currency as investors become less confident in the country’s economy. |

| Commodity prices | South Africa is a major exporter of commodities, such as gold and diamonds. When commodity prices are high, the ZAR tends to strengthen. |

| Global economic conditions | The global economy can also impact the exchange rate between the ZAR and the USD. For example, a strong global economy will typically lead to a stronger USD, which will make the ZAR weaker. |

Table 3: Tips and Tricks for Saving Money

| Tip | Explanation |

|---|---|

| Shop around | Compare exchange rates from different banks and currency exchange companies before you exchange your money. |

| Use a credit card | Credit cards typically offer better exchange rates than banks or currency exchange companies. |

| Avoid using your bank’s ATM | Bank ATMs typically charge high fees for currency exchange. |

| Use a currency transfer service | Currency transfer services can offer competitive exchange rates and low fees. |

Table 4: Common Mistakes to Avoid

| Mistake | Explanation |

|---|---|

| Don’t exchange your money at the airport | Airport currency exchange rates are typically much higher than the rates you will find at banks or currency exchange companies. |

| Don’t exchange your money in small amounts | The smaller the amount of money you exchange, the worse the exchange rate you will get. |

| Don’t be afraid to negotiate | You can often negotiate a better exchange rate by talking to the currency exchange company. |